Loaner Management Software: A Strategic Investment for Efficient Asset Utilization

In today’s fast-paced industries, managing loaned equipment, devices, or assets effectively is more critical than ever. Companies across healthcare, retail, manufacturing, and other sectors face the challenge of tracking and maintaining loaner items while meeting customer expectations and compliance standards. Loaner management software, developed by a reliable software development company, offers a cutting-edge solution to streamline these processes. Beyond simple inventory tracking, these tools empower businesses to optimize asset utilization, reduce operational costs, and deliver a seamless customer experience. As competition grows and compliance requirements tighten, adopting a reliable loaner management system is no longer optional – it’s an essential strategy for sustainable growth.

What Is Loaner Management Software?

Loaner Management Software refers to digital solutions designed to manage, track, and optimize the use of loaner assets across an organization. These systems automate the entire lifecycle of loaner assets, from allocation and tracking to return and maintenance, ensuring that assets are efficiently utilized and properly maintained. With real-time monitoring, automated notifications, and robust reporting capabilities, this software helps businesses reduce downtime, prevent loss or damage, and enhance overall asset utilization.

At its core, Loaner Management Software simplifies the complex processes associated with managing temporary assets. By integrating with existing ERP and CRM systems, these tools provide a unified platform where data flows seamlessly, empowering managers to make informed decisions and drive operational efficiency.

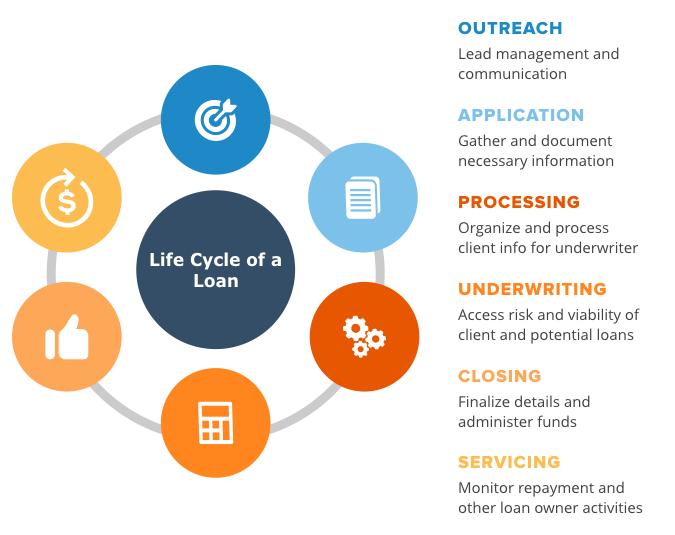

Loan life cycle (source: Techjokey)

Why Loaner Management Software Is Essential

Optimized Asset Utilization

By automating asset tracking and management, Loaner Management Software helps organizations optimize the use of their loaner assets. This leads to increased asset availability, reduced downtime, and more efficient utilization of resources—ultimately enhancing overall productivity.

Cost Savings and ROI Improvement

Automated processes reduce the need for manual intervention and minimize errors, leading to significant cost savings. Efficient asset management reduces maintenance costs, prevents asset loss, and improves scheduling accuracy, resulting in a higher return on investment (ROI). Studies by Forrester suggest that businesses can reduce operational costs by up to 25% by implementing automated asset management solutions.

Improved Customer Satisfaction

For businesses that provide loaner assets to customers—such as rental companies or service centers—efficient asset management is key to enhancing customer satisfaction. A well-organized system ensures that assets are available when needed and maintained in optimal condition, leading to better service delivery and improved customer trust.

Enhanced Data-Driven Decision Making

Access to comprehensive reporting and analytics enables managers to make informed decisions regarding asset allocation, maintenance schedules, and overall strategy. Real-time insights allow for proactive adjustments and continuous improvement, ensuring that asset management practices evolve in response to changing business needs.

Streamlined Operations and Reduced Administrative Burden

By automating the entire lifecycle of loaner assets, organizations can significantly reduce the administrative workload associated with manual processes. This frees up valuable time for staff to focus on strategic tasks, thereby improving overall operational efficiency.

Future Trends in Loaner Management Software

1. Integration with IoT and Real-Time Analytics

The future of Loaner Management Software will be driven by the integration of IoT devices and advanced analytics. Real-time data collection through IoT sensors will enable even more precise tracking and proactive maintenance of loaner assets. This integration will further optimize asset utilization and drive cost savings.

2. Increased Adoption of Cloud-Based Solutions

Cloud-based platforms offer scalability, flexibility, and cost-effectiveness—making them ideal for Loaner Management Software. As businesses increasingly migrate to the cloud, these solutions will provide real-time updates and seamless integration with other enterprise systems, enhancing overall operational efficiency.

3. Enhanced Mobile Capabilities

Mobile accessibility is critical in today’s fast-paced business environment. Future developments in Loaner Management Software will focus on delivering robust mobile applications that allow users to manage and track assets on the go. This will be particularly beneficial for field operations and remote asset management.

4. Advanced Security Features

As digital asset management systems handle sensitive data, robust security features will remain a priority. Future software solutions will incorporate enhanced encryption, multi-factor authentication, and real-time security monitoring to protect assets and ensure compliance with regulatory standards.

5. AI and Machine Learning for Predictive Maintenance

The integration of AI and machine learning will enable predictive maintenance capabilities, allowing businesses to forecast potential equipment failures and schedule maintenance proactively. This will further reduce downtime and extend the lifespan of assets, resulting in significant cost savings.

Case Studies of Loaner Management Software Success

Case Study 1: Optimizing Fleet Management for a Logistics Company

Background:

A leading logistics company faced challenges managing its fleet of loaner vehicles, with frequent delays and inefficiencies in asset tracking and maintenance.

Solution:

The company implemented a comprehensive Loaner Management Software solution that integrated GPS tracking and automated scheduling. This allowed for real-time monitoring of vehicle locations, streamlined reservation processes, and proactive maintenance notifications.

Results:

- 30% reduction in fleet downtime.

- 25% improvement in on-time deliveries.

- Significant cost savings due to efficient maintenance scheduling.

By leveraging real-time data and automation, the logistics company was able to enhance operational efficiency and reduce costs, demonstrating the transformative impact of effective asset management.

Case Study 2: Enhancing Customer Service in a Rental Service

Background:

A rental service provider struggled with inefficient management of its loaner equipment, leading to frequent scheduling conflicts and customer dissatisfaction.

Solution:

The provider adopted Loaner Management Software to automate asset reservations, track usage in real time, and manage return schedules efficiently. The system also integrated with their existing CRM, providing a unified view of customer interactions and asset status.

Results:

- 20% increase in customer satisfaction ratings.

- 25% reduction in scheduling conflicts.

- Improved asset utilization leading to a 15% boost in revenue.

The digital transformation of asset management not only improved operational efficiency but also significantly enhanced the customer experience, proving critical in a highly competitive rental market.

Case Study 3: Streamlining Equipment Management in Healthcare

Background:

A regional healthcare provider needed to improve the management of its loaner medical equipment to ensure timely availability for patient care and reduce operational costs.

Solution:

The provider implemented a Loaner Management Software system that automated the entire process—from asset check-out and return to maintenance scheduling. Real-time tracking and robust analytics enabled the provider to optimize equipment usage and streamline operations.

Results:

- 30% reduction in equipment downtime.

- 20% improvement in operational efficiency.

- Enhanced patient care through timely equipment availability.

This case study illustrates how digital asset management can directly impact service delivery and cost efficiency in healthcare, ensuring that critical resources are effectively managed.

Watch this video to see real-world transformations in action!

FAQs

What features should I look for in a loaner management software?

Key features include:

- Real-time tracking of assets via barcodes or RFID.

- Automated scheduling for equipment loans and returns.

- Customizable reporting to monitor usage patterns.

- Integration capabilities with existing enterprise systems like ERP or CRM.

- Mobile accessibility for on-the-go asset management.

Selecting software from a trusted software development company ensures these features are tailored to your needs.

How long does it take to implement loaner management software?

Implementation time varies depending on the complexity of your organization’s requirements and the software’s customization needs. A basic solution can take a few weeks, while a highly tailored system might take several months. Partnering with an experienced software development company can significantly reduce implementation delays.

Can loaner management software integrate with existing business tools?

Yes, many solutions are designed to integrate seamlessly with enterprise tools like ERPs, CRMs, and inventory management systems. Integration ensures data consistency and helps organizations leverage their existing technology investments for maximum efficiency.

Unlock Efficiency and Drive Success with Loaner Management Software

The adoption of loaner management software is not just a step towards operational improvement—it’s a leap towards innovation, customer satisfaction, and long-term growth. By automating asset tracking, ensuring compliance, and providing actionable insights, businesses can transform their workflows and gain a competitive edge. However, success depends on selecting the right solution tailored to your needs and implementing it strategically.

Savvycom, a trusted software development company, specializes in crafting tailored solutions to meet unique business challenges. Whether you’re looking for custom integrations, robust analytics, or end-to-end implementation support, Savvycom is your partner in driving efficiency through technology. Don’t just manage your loaners—excel at it. Contact Savvycom today to explore how our solutions can revolutionize your operations and help you stay ahead in an ever-evolving marketplace.

Tech Consulting, End-to-End Product Development, Cloud & DevOps Service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]