Transforming the Customer Experience with Omnichannel Banking

In today’s fast-paced digital landscape, banks and financial institutions must continuously evolve to meet the rising expectations of modern consumers. Traditional banking models, which once relied heavily on in-person interactions, are being replaced by a more flexible and interconnected approach—omnichannel banking. This transformation ensures that customers receive a seamless and personalized banking experience across multiple platforms, from mobile apps to physical branches.

With the rapid rise of fintech, the demand for digital banking solutions has surged. Consumers now expect the same level of convenience from banks as they do from online retailers, requiring institutions to rethink how they engage with customers. By leveraging digital transformation solutions, banks can integrate their services into a cohesive network that provides consistent, real-time interactions across all touchpoints.

This blog will explore how omnichannel banking enhances the customer experience, the technological advancements driving this shift, and real-world examples of successful implementation.

What is Omnichannel Banking?

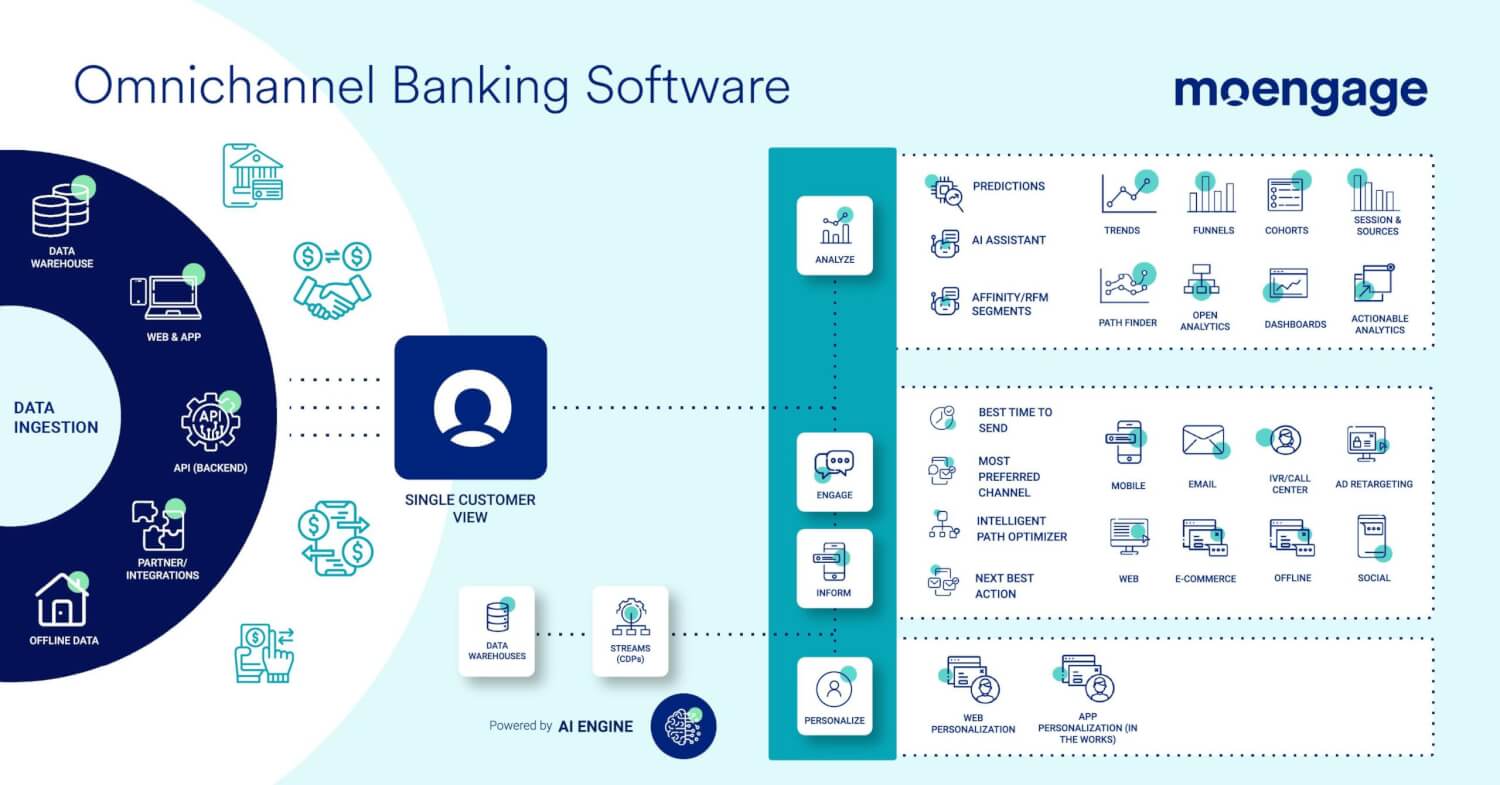

Omnichannel banking is a strategy that unifies multiple banking channels—such as mobile apps, websites, ATMs, and in-person branches—into a single, integrated experience. Unlike multichannel banking, where each channel operates independently, omnichannel banking ensures that all channels are interconnected, allowing customers to start a transaction on one platform and complete it on another without disruption.

Image source: moengage

For example, a customer might begin applying for a loan via a mobile banking app but later visit a branch to complete the process. With omnichannel banking, all their information is synchronized across systems, eliminating the need to restart the process or provide duplicate documentation. This seamless interaction fosters higher customer satisfaction and engagement.

The Importance of Omnichannel Banking in Enhancing Customer Experience

1. Seamless and Consistent Experience Across All Channels

Customers today interact with banks through multiple touchpoints, including smartphones, computers, ATMs, and physical branches. A fragmented experience across these channels can lead to frustration and decreased customer satisfaction.

A well-executed omnichannel banking approach ensures that customers receive the same quality of service regardless of how they interact with their bank. Whether checking their balance online, speaking to a customer service representative, or visiting a branch, their information remains consistent and readily available.

2. Personalized Customer Interactions

Banks that utilize fintech software development services can harness AI-driven analytics to offer personalized recommendations and financial insights. By analyzing customer behavior, spending patterns, and preferences, banks can tailor their services to meet individual needs.

For example, a customer who frequently travels abroad may receive tailored offers on international credit cards or currency exchange services. Personalization not only enhances engagement but also builds long-term customer loyalty.

3. Increased Accessibility and Flexibility

With digital transformation solutions, banks can extend their reach to underserved populations who may not have easy access to physical branches. Features such as mobile banking, remote account opening, and virtual customer support ensure that customers can manage their finances anytime, anywhere.

A study found that banks that embrace digital-first strategies see a 10-20% increase in customer retention rates. This highlights the importance of accessibility in fostering long-term relationships with customers.

4. Enhanced Security and Fraud Prevention

With financial transactions shifting to digital channels, security has become a top priority. Omnichannel banking integrates advanced cybersecurity measures such as biometric authentication, AI-driven fraud detection, and encrypted transactions to safeguard customer data. Banks that adopt digital banking solutions can proactively detect suspicious activities and prevent fraud in real time, enhancing trust and reliability.

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

Key Technologies Powering Omnichannel Banking

Image source: Integrated Research

1. AI and Machine Learning for Smarter Banking

Artificial intelligence (AI) plays a crucial role in optimizing omnichannel banking. AI-powered chatbots, predictive analytics, and automated financial advisors enhance customer interactions by providing real-time insights and support.

For instance, AI can analyze spending habits to suggest savings plans or detect anomalies that might indicate fraudulent activities. According to a report, 95% of business leaders in customer service anticipate the integration of AI bots in customer interactions over the next three years.

2. Cloud Computing for Scalability and Efficiency

Banks leveraging cloud-based fintech software development services can seamlessly manage vast amounts of customer data while ensuring security and compliance. Cloud computing allows banks to scale their operations efficiently, improving data synchronization across multiple channels.

3. Blockchain for Secure Transactions

Blockchain technology enhances the security and transparency of banking transactions. By utilizing decentralized ledgers, banks can reduce fraud, improve transaction speed, and enhance trust in digital payments. This technology is particularly beneficial for cross-border transactions and identity verification.

Case Studies of Successful Omnichannel Banking Implementation

Among the most successful case studies of omnichannel banking implementation are Monzo and Starling Bank—two UK-based fintech disruptors that have outperformed traditional banks through agile technology, personalized services, and omnichannel engagement. Monzo and Starling Bank’s omnichannel banking strategy serves as a benchmark for financial institutions aiming to enhance customer satisfaction and digital transformation. By integrating mobile-first banking, AI-powered financial tools, and cloud-based scalability, they have set a new standard for modern banking.

According to a report by The Sun, Monzo has achieved an 80% customer recommendation rate, significantly higher than most legacy banks. This success is attributed to its omnichannel banking approach, which integrates mobile banking, AI-powered financial insights, and real-time customer support.

How Monzo and Starling Bank Reinvented Banking with Omnichannel Strategies

Monzo and Starling Bank offer seamless banking experiences that span multiple touchpoints, including mobile apps, web platforms, and API integrations. Unlike traditional banks that often rely on physical branches and outdated systems, these digital banks use a cloud-based infrastructure to ensure frictionless customer interactions.

Image source: lookingafteryourpennies

1. Digital-First Onboarding & Seamless Customer Journey

One of the biggest advantages of Monzo and Starling Bank is their fast, fully digital onboarding process. Traditional banks require customers to visit branches, submit physical documents, and wait several days for account approval. In contrast, these digital banks offer:

- Instant account opening via mobile apps, using biometric ID verification.

- Paperless banking, reducing bureaucracy and enhancing efficiency.

- Seamless integration across devices, allowing users to manage their accounts on smartphones, tablets, and desktops.

With this streamlined process, both banks have significantly improved customer acquisition rates, proving the power of digital-first omnichannel banking.

2. AI-Driven Financial Management and Smart Banking Tools

Monzo and Starling Bank leverage artificial intelligence (AI) and data analytics to provide customers with intelligent banking tools. These features help users track their spending, set savings goals, and make informed financial decisions.

- Monzo’s “Salary Sorter” & “Pots” feature allows users to automatically divide their income into different categories, making budgeting effortless.

- Starling Bank’s “Spending Insights” provides detailed reports on spending patterns, helping users optimize their finances.

- Real-time transaction alerts ensure customers stay informed about their account activity, reducing fraud risks.

These AI-powered features enhance customer engagement and loyalty, making omnichannel banking a key driver of Monzo and Starling’s success.

3. 24/7 Customer Support & Chat-Based Banking

Traditional banks often suffer from long customer service wait times, frustrating users who need immediate assistance. Monzo and Starling Bank solve this issue by offering:

- 24/7 in-app chat support, eliminating the need for phone calls or branch visits.

- AI-powered chatbots that provide instant answers to common queries.

- Human support escalation, ensuring complex issues are resolved efficiently.

This omnichannel support system ensures that customers receive instant, round-the-clock assistance, a critical advantage in modern banking.

4. Transparent & Customer-Friendly Banking Services

Unlike traditional banks, which often impose hidden fees and complex pricing structures, Monzo and Starling Bank prioritize fee transparency and customer-friendly policies:

| Feature | Monzo & Starling Bank | Traditional Banks |

|---|---|---|

| Customer Recommendation Rate | 80% (Monzo) | 60-70% (Average Traditional Bank) |

| Account Opening Time | 10 Minutes | 1-5 Days |

| Customer Support | 24/7 In-App Chat | Limited Business Hours |

| Fee Transparency | No Hidden Fees | Overdraft & FX Fees |

| AI-Powered Insights | Yes | Limited |

| Real-Time Transactions | Yes | Often Delayed |

This approach has resulted in higher customer trust and loyalty, proving that an omnichannel, customer-first strategy is a key differentiator in modern banking.

5. Agile Technology Infrastructure: Cloud & Open Banking

A major challenge for traditional banks is their reliance on legacy core banking systems, which are expensive to maintain and difficult to upgrade. Monzo and Starling Bank, however, leverage cloud computing, APIs, and open banking frameworks, allowing them to:

- Launch new features rapidly without disrupting services.

- Integrate with third-party fintech providers, enhancing their banking ecosystem.

- Ensure real-time transactions and seamless financial management.

By utilizing agile software development and API-driven architecture, Monzo and Starling Bank provide scalable and resilient banking solutions that adapt to evolving customer needs.

The Impact of Omnichannel Banking on Customer Experience

Monzo and Starling Bank’s success showcases the power of omnichannel banking in transforming customer experiences. Their digital-first strategies have led to:

✅ Higher customer engagement due to seamless mobile banking.

✅ Faster problem resolution through AI-driven customer support.

✅ Greater financial empowerment with real-time insights and budgeting tools.

✅ Increased customer retention through a transparent, fee-friendly approach.

The Future of Omnichannel Banking

As consumer expectations continue to rise, the future of omnichannel banking will be shaped by several key trends:

-

Hyper-Personalization – AI-driven insights will enable banks to offer even more customized financial solutions.

-

Voice and Biometric Authentication – Enhanced security measures will reduce fraud while streamlining customer interactions.

-

Embedded Banking – Banking services will integrate seamlessly into third-party apps and platforms, offering even greater convenience.

-

Sustainability in Banking – Green banking initiatives and digital-only models will contribute to reduced environmental impact.

By adopting digital banking solutions and continuously innovating, banks can stay ahead of the curve and deliver exceptional customer experiences.

Conclusion

Omnichannel banking is more than just a convenience—it is a necessity for banks that aim to thrive in the digital era. By integrating all banking channels into a unified, customer-centric experience, financial institutions can enhance engagement, improve accessibility, and build lasting relationships.

The key to success lies in leveraging fintech software development services to implement AI-driven personalization, advanced security measures, and real-time data synchronization. As digital transformation accelerates, banks that prioritize omnichannel banking will emerge as leaders in the industry.

Savvycom is a trusted software development company specializing in cutting-edge digital transformation solutions for the banking and fintech industries. With expertise in fintech software development services, we help financial institutions integrate digital banking solutions into their operations, ensuring seamless omnichannel experiences for customers. Our commitment to innovation and security makes us the ideal partner for banks looking to stay ahead in the digital age.

Partner with Savvycom today to revolutionize your banking experience.

Tech Consulting, End-to-End Product Development, Cloud & DevOps Service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]