Transform your B2B transactions with our seamless Digital Payment Services! We offer swift, secure, and smooth payment processing systems tailored for the modern business landscape. Say goodbye to manual hassles and embrace efficiency, empowering your enterprise with the speed and reliability needed to thrive in the digital economy. Get ready for a frictionless financial future!

B2B & Digital Payment Solutions

Savvycom Digital Payment Solutions

Streamline your B2B payments with our sleek Digital Payment Solutions! Fast, secure, and hassle-free, they’re designed to power up your business transactions. Embrace the ease of modern finance!

Revolutionize your financial transactions with our bespoke Payment Software Development Services! Tailored to your unique business needs, our solutions offer unmatched security, efficiency, and ease of use. We’re the best option in your payment processing companies list, who can ensure smooth, swift, and secure transfers, laying the foundation for your successful digital transformation. Join us to redefine the future of financial exchanges!

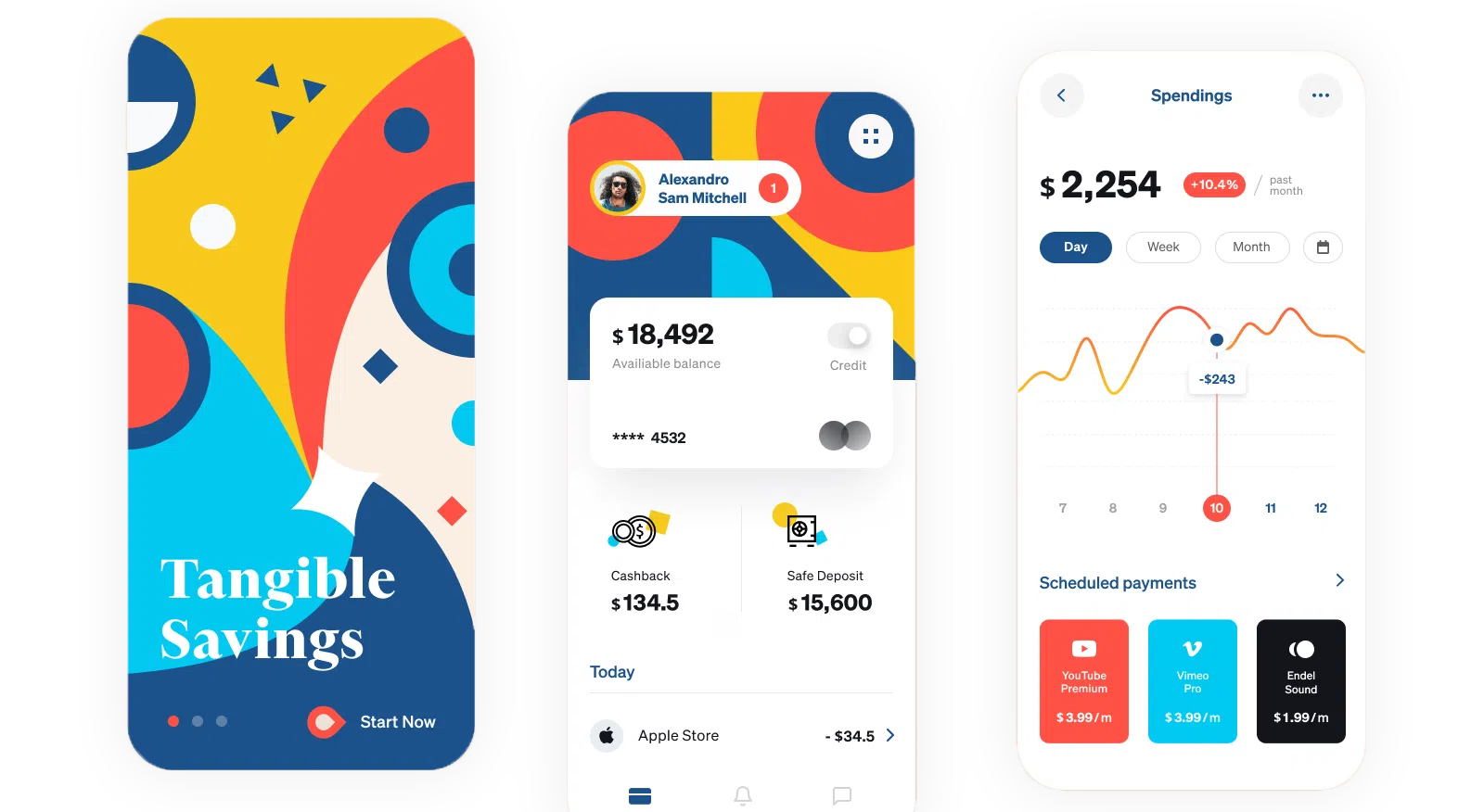

Payment App Development

Elevate your payment experience with our custom Payment App Development services. We craft intuitive, secure, and rapid mobile payment applications that keep you at the forefront of the digital economy. Get ready for seamless transactions and a wallet that travels with your customers, wherever they go. Your payment revolution starts here!

Payment Automation Software

Unleash efficiency with our Payment Automation Software, where precision meets convenience. Expect a streamlined solution that simplifies transactions, minimizes errors, and accelerates your financial workflows. Step into an era of effortless payments and let automation drive your business forward.

Payment Orchestration Software

Navigate the symphony of digital payments with our Payment Orchestration Software. It’s a harmonious solution that integrates multiple payment gateways and services, offering a centralized, efficient transaction management system. Elevate your payment strategy and conduct your business’s financial score with finesse and control.

Buy Now Pay Later Application

Our Buy Now Pay Later Application technology redefines flexible spending with an intelligent, user-centric approach. By leveraging AI for credit assessments and real-time risk analytics, we provide a secure, seamless integration for deferred payment options. This cutting-edge application empowers consumers with choice and control, while driving forward the evolution of responsible financial technology.

Money Transfer App Development

Embark on a financial odyssey with our bespoke Money Transfer App Development, where state-of-the-art encryption meets the artistry of design. Imagine a world where blockchain brilliance and meticulous compliance converge to ensure your every transaction is not just a transfer but a statement of security and speed. Our apps don’t just move money; they propel you into a realm of instant, effortless financial connectivity.

Leverage Our Experience To Implement The Perfect B2B Digital Payment Solutions

Reasons To Work With Us

In addition to offering bespoke digital banking solutions development expertise, one of our foremost priorities is fostering a relationship of trust and ensuring our clients feel completely at ease when partnering with us.

Deep-Rooted Industry Experience

With a rich history spanning nearly ten years in web, app, and system creation, our team is armed with the know-how and tools to deliver digital banking solutions that elevate business and boost your bottom line.

Collaborative Communication

We’re all about teamwork and transparency. From day one, we work hand-in-hand with our clients, keeping you in the loop with regular check-ins and clear reports.

Continued Support After Launch

Think of Savvycom as your long-term ally. Our commitment doesn’t end at launch. In fact, 70% of our clients stick with us for support services well beyond three years post-launch, because we’re invested in your enduring success.

Top-Notch Quality

Quality is our mantra. Our engineers are wizards with both manual and automated tests, ensuring that every digital banking solution we craft sets you up for success.

Punctuality We Pride Ourselves On

We’re sticklers for schedules and believe your time is gold. With smart planning and sharp risk management, deadlines aren’t just met – they’re conquered.

Our Development

Process at Savvycom

Here’s how we make it happen, from the napkin sketch to a full-fledged product.

01

Discovery

Kicking off digital banking solutions development with business and technical analysis, we establish estimates and timelines, culminating in a digital product prototype.

02

Design

The digital prototype transforms into detailed UX/UI designs, crafted with the user in mind while aligning with business objectives.

03

Development

Here, the product comes to life as hi-fidelity mockups turn sketches into a tangible, interactive app experience.

04

Testing & Improvements

Our QA team ensures your product functions flawlessly; any issues found are promptly addressed.

05

Soft Launch

The product greets early users, their feedback is gathered, and improvements are made, all with the aim of crafting a product that truly resonates.

06

Launch

We celebrate with champagne and gear up for future updates, because staying ahead means continuous enhancement.

Leverage the experience of Savvy Team to build your product

What Business Leaders Say About Savvycom

We deeply appreciate all feedbacks to improve the quality of our services!

FAQ about Savvycom – Leading IT Outsourcing Company in Vietnam

How Much Does Software Development Cost?

The cost of software development can vary widely depending on factors such as project complexity, required features, development time, and the software development company's expertise.

What Is Software Development?

Software development involves creating, designing, and maintaining computer programs or applications. It encompasses the process of writing, testing, and deploying software solutions to meet specific needs, often undertaken by a software development company.

Does Savvycom cover all stages of the SDLC?

As a leading software development company, Savvycom covers all stages of the Software Development Life Cycle (SDLC), including initial planning, analysis, design, development, testing, deployment, and maintenance.

What Is The Purpose Of A Software Development Company?

The purpose of a software development company is to create, design, and maintain software solutions tailored to meet the needs of clients or end-users.

What Is The Organizational Structure Of A Software Development Team?

The organizational structure of a software development team typically includes roles such as project managers, software engineers, quality assurance testers, designers, and sometimes product managers or business analysts.

What Are The 07 Steps Of Software Development Life Cycles?

Partner with Savvycom to elevate and streamline each phase of your SDLC:

- Planning: Savvycom strategizes with you, defining clear objectives aligned with your vision.

- Analysis: Our team conducts thorough requirements analysis, ensuring feasibility and optimal solutions.

- Design: Savvycom's expert designers create intuitive and aesthetically pleasing software structures.

- Development: Our developers, proficient in the latest technologies, construct robust software.

- Testing: Savvycom's rigorous testing processes verify functionality and identify potential issues.

- Implementation: We ensure smooth deployment of your software, minimizing disruption.

- Maintenance: Savvycom provides regular updates and troubleshooting, ensuring your software remains efficient and effective.

What Is A Software Development Company?

A software development company is a business that specializes in creating and maintaining software applications. At Savvycom, we work with clients to understand their needs, design and develop the software, test to make sure it functions correctly, and then provide ongoing support and updates.