What is Fraud Risk Assessment?

Fraud is a growing concern for businesses of all sizes, with global losses due to fraud amounting to billions of dollars annually. According to the Association of Certified Fraud Examiners (ACFE), organizations lose an estimated 5% of their annual revenue to fraud. A fraud risk assessment is a structured process that helps organizations identify, evaluate, and mitigate potential fraud risks, ensuring compliance with regulatory requirements and protecting financial assets. In today’s digital age, companies, including software development companies, must proactively implement fraud risk assessment strategies to safeguard their operations and reputation.

Understanding Fraud Risk

Fraud risk refers to the possibility of individuals or entities engaging in deceptive activities to obtain financial or personal gain unlawfully. Fraud can occur in various forms, including asset misappropriation, financial statement fraud, cyber fraud, and corruption. The 2022 PwC Global Economic Crime and Fraud Survey reported that 51% of companies experienced fraud in the past two years, emphasizing the growing threat across industries. Organizations that lack effective fraud risk management frameworks expose themselves to financial loss, reputational damage, and legal repercussions.

Image source: slide player

Fraud under the UK Fraud Act 2006

The UK Fraud Act 2006 provides a legal framework for addressing fraudulent activities. The Act categorizes fraud into three main types:

-

Fraud by false representation – Making dishonest statements to gain an advantage.

-

Fraud by failing to disclose information – Withholding crucial details to deceive others.

-

Fraud by abuse of position – Exploiting a position of trust to commit fraud.

Understanding these legal definitions helps businesses implement robust fraud prevention measures within their fraud risk assessment strategy. Non-compliance with this Act can result in severe penalties, including imprisonment and substantial fines, underscoring the necessity for thorough fraud risk management.

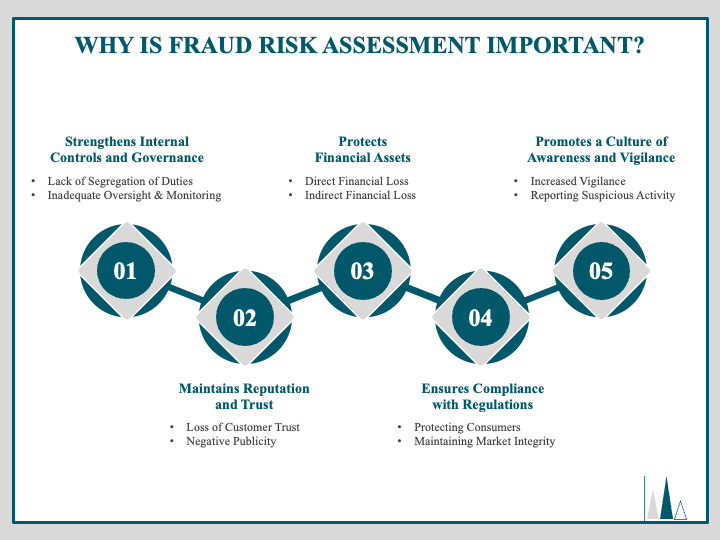

Why Is a Fraud Risk Assessment Important?

A fraud risk assessment is essential for several reasons:

Image source: Sketchbubble

-

Regulatory compliance: Many industries require organizations to perform regular fraud risk assessments to comply with financial regulations. These regulations ensure transparency, accountability, and corporate governance, ultimately reducing the risk of fraudulent activities.

-

Financial protection: Fraud can cause significant financial damage, and early detection can prevent substantial losses. The ACFE’s 2022 Report to the Nations found that fraud cases typically last 12 months before detection, causing median losses of $117,000 per case. In some instances, undetected fraud can lead to multi-million-dollar losses, crippling businesses.

-

Reputation management: A fraud scandal can severely harm an organization’s reputation, leading to customer distrust and reduced business opportunities. Companies that fail to address fraud risks often experience declining stock prices, legal battles, and loss of investor confidence.

-

Operational efficiency: Identifying fraud risks allows businesses to implement cost-effective security measures. A proactive fraud risk assessment helps optimize resources by prioritizing critical risks and deploying preventive strategies effectively.

Get in touch with Savvycom for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

What Should a Fraud Risk Assessment Address?

A comprehensive fraud risk assessment should cover various aspects of an organization’s operations, including:

Asset Misappropriation

This is the most common type of occupational fraud, where employees steal company assets such as cash, inventory, or equipment. The ACFE reports that 86% of occupational fraud cases involve asset misappropriation. Common methods include fraudulent expense reimbursements, check tampering, and payroll fraud. Organizations must implement internal controls, such as segregation of duties and mandatory vacations, to reduce such risks.

Financial and Non-Financial Reporting

Fraudulent financial reporting involves misrepresenting financial statements to deceive investors, regulators, or stakeholders. The Enron and WorldCom scandals highlight the catastrophic consequences of financial fraud, leading to billions of dollars in losses and widespread economic disruption. Organizations must ensure transparency in financial disclosures to avoid legal consequences, implement automated financial monitoring tools, and conduct independent audits.

Regulatory Compliance Areas

Many industries must comply with financial risk management regulations, such as the Sarbanes-Oxley Act in the U.S. and the UK Bribery Act. A fraud risk assessment ensures organizations adhere to these regulations, reducing the risk of fines or legal action. Non-compliance with anti-fraud laws can result in penalties exceeding millions of dollars. In 2020 alone, companies paid $2.6 billion in penalties for violating the Foreign Corrupt Practices Act (FCPA).

Illegal Acts

Some fraud schemes involve illegal activities such as bribery, insider trading, and money laundering. Companies should have mechanisms in place to detect and prevent such actions. The UN Office on Drugs and Crime (UNODC) estimates that money laundering accounts for 2-5% of global GDP annually, equivalent to approximately $800 billion to $2 trillion. Implementing big data risk analysis and AI-driven fraud detection can help mitigate these threats effectively.

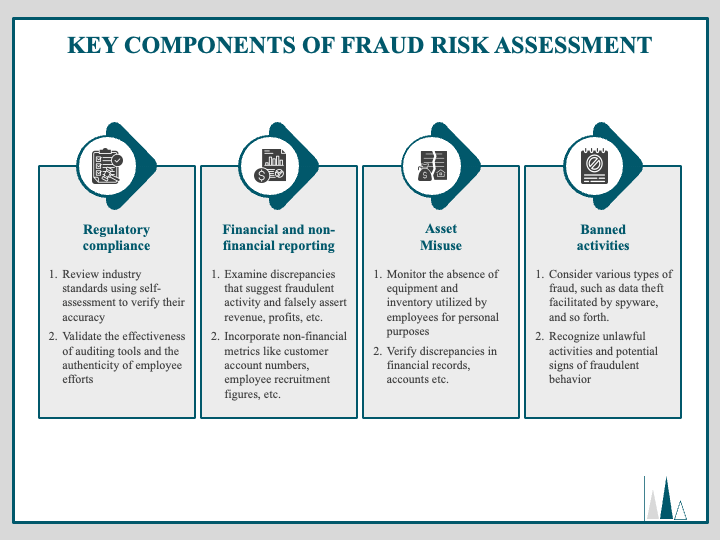

What Are the Main Fraud Risk Assessment Components?

A robust fraud risk assessment consists of key components, including:

Image source: Sketchbubble

-

Risk identification: Understanding potential fraud risks within the organization by analyzing past fraud cases, industry trends, and internal weaknesses.

-

Risk evaluation: Assessing the likelihood and impact of each fraud risk to prioritize mitigation efforts effectively.

-

Control measures: Implementing internal controls, fraud detection technologies, and policies to reduce fraud risks.

-

Monitoring and review: Regularly updating fraud risk assessment procedures to adapt to emerging threats, regulatory changes, and technological advancements.

Steps to Conduct a Fraud Risk Assessment

1. Establish a Fraud Risk Management Framework (7-Step Fraud Risk Assessment Framework)

Organizations should follow a structured framework, such as the 7-step fraud risk assessment framework, to systematically evaluate risks and implement controls. This framework includes:

-

Define objectives for fraud risk management.

-

Identify potential fraud risks across all business units.

-

Assess risk impact and likelihood.

-

Implement preventive and detective controls.

-

Develop response strategies for fraud incidents.

-

Monitor and review fraud risk management efforts.

-

Continuously improve fraud detection systems.

2. Identify Potential Fraud Risks

Companies must analyze their operations to detect potential fraud risks. This includes evaluating historical fraud cases, assessing industry-specific threats, and leveraging big data risk analytics. The use of AI and machine learning enables organizations to recognize suspicious patterns and anomalies in transactions, improving fraud detection accuracy.

3. Analyze and Evaluate Risks

Fraud risks should be assessed based on probability and potential financial impact. Organizations should categorize risks into high, medium, and low priorities and allocate resources accordingly.

4. Implement Controls to Mitigate Risks

Organizations should introduce fraud prevention measures, such as:

-

Segregation of duties to prevent unauthorized access to sensitive data.

-

Real-time transaction monitoring systems to detect anomalies.

-

Automated fraud detection systems powered by AI.

-

Strong internal controls like multi-factor authentication and encryption.

5. Monitor and Review Continuously

Fraud risks evolve over time. Continuous monitoring, including big data risk analysis, enables organizations to adapt to new fraud tactics and strengthen their defenses. Conducting periodic fraud risk assessments ensures businesses remain compliant with financial risk management regulations and industry best practices.

Minimizing Fraud Risk: Key Strategies

To effectively mitigate fraud risks, organizations should adopt these key strategies:

-

Foster a culture of integrity: Encourage ethical behavior and transparent communication within the organization.

-

Conduct comprehensive employee training: Equip employees with the knowledge to detect and report fraudulent activities.

-

Implement strong reporting mechanisms: Provide anonymous reporting channels for employees to report suspicious activities without fear of retaliation.

-

Leverage technology and data analytics: Utilize AI-driven fraud detection tools and financial risk management software to identify fraud patterns.

-

Perform regular audits and testing: Conduct internal and external audits to ensure compliance and detect fraud early.

Embed Fraud Prevention into Business Operations

Integrating fraud prevention into daily business operations requires a proactive approach rather than a reactive one. Organizations should embed fraud risk management into corporate culture, policies, and technology to create a resilient defense against fraudulent activities.

-

Make Fraud Prevention a Leadership Priority

Fraud risk management should not be limited to compliance teams—it must be a leadership priority. When executives and board members actively advocate for ethical practices, the entire organization follows suit. Companies with strong leadership commitment to fraud prevention experience lower incidences of fraud, as employees recognize that unethical behavior will not be tolerated. -

Incorporate Fraud Prevention into Business Strategy

Fraud prevention should be an essential part of business strategy rather than a separate initiative. Organizations must integrate fraud risk assessments into financial risk management strategies, procurement processes, and internal audits. Companies that align fraud prevention with operational goals are more effective in minimizing financial losses and reputational damage. -

Use Technology to Strengthen Fraud Detection

Modern businesses can leverage financial risk management software powered by AI, big data analytics, and blockchain to detect suspicious transactions and prevent fraudulent activities in real time. These tools enable organizations to process vast amounts of data, identify anomalies, and generate automated alerts, ensuring a proactive approach to fraud detection. A big data risk assessment can further enhance fraud prevention by identifying emerging threats based on historical fraud patterns. -

Strengthen Third-Party Risk Management

Fraud often arises from external partnerships, such as vendors, suppliers, and contractors. Organizations should conduct due diligence when onboarding third parties and establish strong contractual obligations to ensure compliance with fraud prevention policies. Implementing continuous monitoring and audits of third-party transactions can significantly reduce fraud risk. -

Develop a Fraud-Resilient Workforce

Employees are the first line of defense against fraud. Organizations must conduct regular fraud awareness training, simulate real-world fraud scenarios, and encourage employees to report suspicious activities through confidential whistleblower channels. Studies indicate that businesses with strong whistleblower programs detect fraud 50% faster than those without. -

Continuously Adapt to Emerging Fraud Threats

The fraud landscape evolves rapidly, requiring businesses to stay ahead of new threats. Companies should regularly update fraud risk assessments, refine internal controls, and leverage predictive analytics to anticipate and mitigate risks before they materialize.

Partner with a Trusted Tech Expert for Fraud Prevention

Implementing a robust fraud prevention strategy requires the right technology and expertise. As a trusted software development company, Savvycom specializes in delivering tailored fraud detection and prevention solutions powered by AI, machine learning, and financial risk management software. Ranked among the top 10 IT providers in Vietnam, we help businesses strengthen their security frameworks, minimize fraud risks, and enhance compliance.

If you are looking for a strategic partner to integrate advanced fraud prevention solutions into your operations, contact Savvycom today to explore how our technology-driven approach can safeguard your business.

Tech Consulting, End-to-End Product Development, Cloud & DevOps Service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]