Fintech’s Impact on Sustainable Finance: Advancing Environmental and Social Goals

In recent years, the rise of financial technology (fintech) has significantly transformed various sectors, and sustainable finance is no exception. Fintech innovations, driven by software development companies, have played a crucial role in advancing environmental and social goals by providing innovative solutions that promote sustainability. This article delves into the profound impact of fintech on sustainable finance, exploring how digital innovations are driving positive change in the financial industry and beyond.

The Intersection of Fintech and Sustainable Finance

The convergence of fintech and sustainable finance has created a dynamic landscape where technological advancements enable more efficient, transparent, and inclusive financial systems. At the heart of this transformation are software development companies, which develop cutting-edge technologies that support the growth of sustainable finance. These companies have leveraged their expertise to create platforms that facilitate green investments, improve transparency, and enhance financial inclusion.

Image source: Research gate

One of the key ways fintech is influencing sustainable finance is through the development of digital platforms that enable individuals and institutions to invest in environmentally and socially responsible projects. For instance, crowdfunding platforms have emerged as a popular avenue for raising capital for renewable energy projects, sustainable agriculture, and social enterprises. These platforms, often powered by sophisticated software solutions, allow investors to pool resources and support projects that align with their values. As a result, they democratize access to investment opportunities and promote the growth of the green economy.

Another significant impact of fintech on sustainable finance is the increased transparency and accountability it brings to financial transactions. Blockchain technology, for example, has revolutionized the way transactions are recorded and verified. By providing a decentralized and immutable ledger, blockchain ensures that all transactions are transparent and traceable, reducing the risk of fraud and corruption. This technology is particularly valuable in sustainable finance, where verifying the authenticity and impact of green projects is crucial. Software development companies specializing in blockchain have developed solutions that enable secure and transparent tracking of funds, ensuring that investments are used for their intended purposes.

Image source: Medium

Moreover, fintech has enhanced financial inclusion by providing access to financial services for underserved populations. Digital payment platforms, mobile banking, and microfinance apps have made it possible for individuals in remote areas to access banking services, saving them from the inconvenience and costs associated with traditional banking. This increased access to financial services empowers individuals to save, invest, and participate in the economy, contributing to poverty alleviation and economic development. As more software development companies focus on creating inclusive fintech solutions, the potential for sustainable finance to reach a broader audience grows exponentially.

Get in touch with Savvycom for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

The Role of Data and Analytics in Sustainable Finance

Data and analytics play a critical role in the fintech-driven transformation of sustainable finance. The ability to collect, analyze, and interpret large volumes of data has opened new avenues for assessing environmental, social, and governance (ESG) factors in investment decisions. Software development companies have been instrumental in developing advanced data analytics tools that provide insights into the sustainability performance of companies and projects. These tools enable investors to make informed decisions based on comprehensive ESG criteria, promoting responsible investing.

One notable example of data analytics in sustainable finance is the use of artificial intelligence (AI) and machine learning (ML) algorithms to assess the impact of climate change on financial assets. Additionally, innovations such as an AI stock picker, designed specifically for sustainable investments, optimize investment strategies by analyzing vast datasets of ESG factors. By predicting how climate-related risks might affect investment portfolios, these technologies provide invaluable information for investors seeking to mitigate risks and align their portfolios with sustainability goals. Software development companies have developed AI-powered platforms that offer climate risk assessments, helping investors navigate the complexities of sustainable finance.

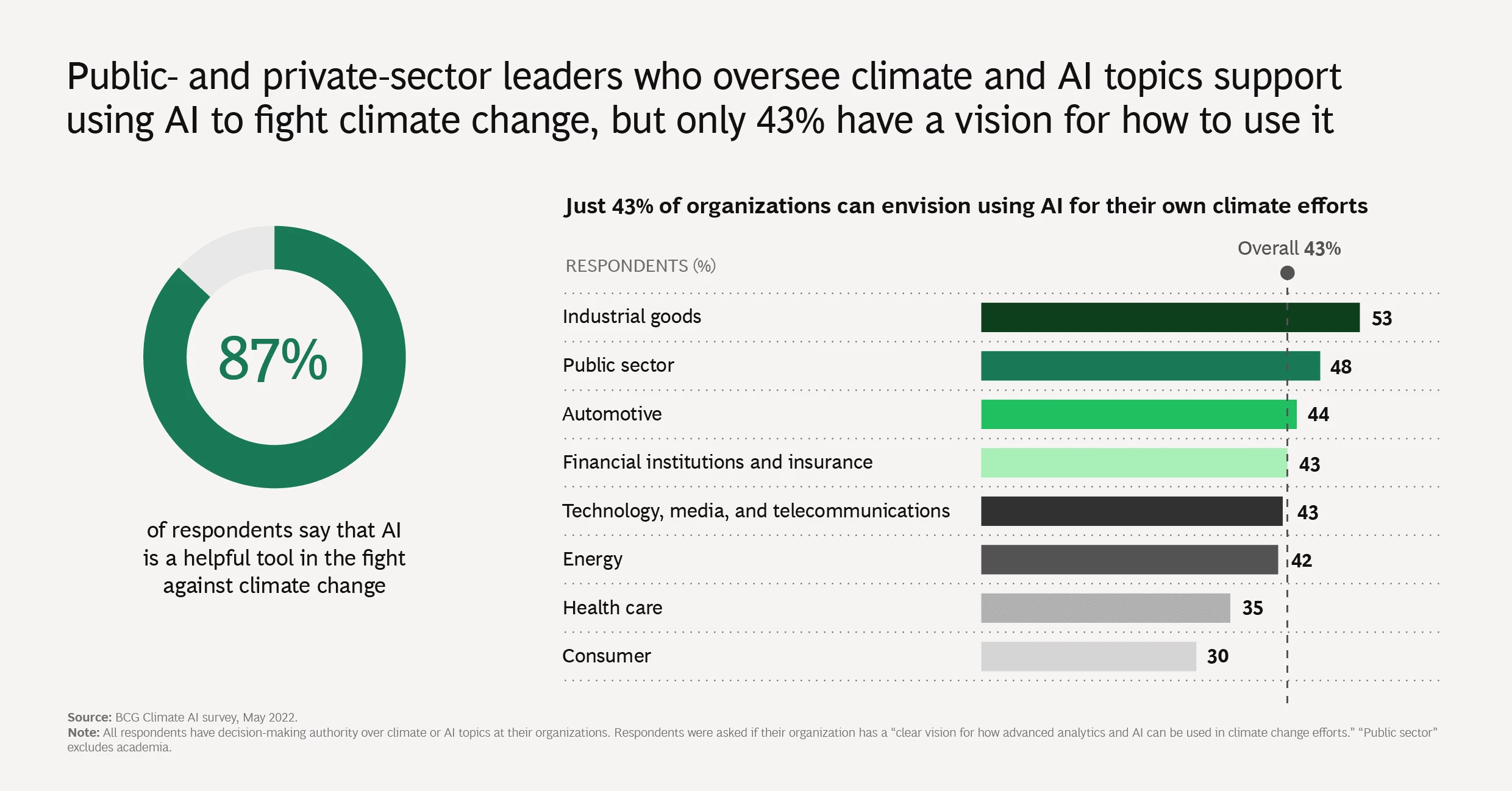

Image source: BCG

Furthermore, data analytics has facilitated the development of green bonds and other sustainable financial instruments. Green bonds are debt securities issued to finance projects that have positive environmental benefits, such as renewable energy, energy efficiency, and clean transportation. The growth of the green bond market has been fueled by the increasing demand for transparent and accountable investment options. Software development companies have created platforms that track the use of proceeds from green bonds, ensuring that the funds are allocated to environmentally friendly projects. These platforms provide real-time reporting and verification, enhancing investor confidence and promoting the growth of sustainable finance.

Case Studies: Fintech Innovations in Sustainable Finance

Several fintech innovations have made significant contributions to advancing sustainable finance. One notable example is the development of digital platforms for carbon trading. Carbon trading is a market-based approach to reducing greenhouse gas emissions, where companies can buy and sell carbon credits to offset their emissions. Traditionally, carbon trading markets have been opaque and complex, making it difficult for participants to access and trade carbon credits. However, fintech innovations have streamlined this process by creating digital platforms that facilitate transparent and efficient carbon trading.

For instance, a software development company developed a blockchain-based platform for carbon trading that ensures the traceability and transparency of carbon credits. This platform allows companies to track their carbon footprint, purchase verified carbon credits, and offset their emissions in a secure and transparent manner. The use of blockchain technology eliminates the risk of double counting and fraud, providing a trustworthy marketplace for carbon trading. This innovation has not only increased the efficiency of carbon markets but also encouraged more companies to participate in carbon offsetting, contributing to global efforts to combat climate change.

Another example of fintech’s impact on sustainable finance is the rise of digital investment platforms focused on impact investing. Impact investing refers to investments made with the intention of generating positive social and environmental impact alongside financial returns. Digital platforms have made impact investing more accessible to a wider audience, including retail investors. These platforms, powered by advanced algorithms and data analytics, curate a selection of impact investments based on investors’ preferences and risk tolerance. By offering a user-friendly interface and comprehensive information on each investment opportunity, these platforms empower investors to align their portfolios with their values and contribute to positive social change.

One such platform, developed by a leading software development company, provides a range of impact investment options, including renewable energy projects, social enterprises, and community development initiatives. The platform uses data analytics to assess the social and environmental impact of each investment, providing investors with transparent and reliable information. This innovation has democratized access to impact investing, enabling more individuals to contribute to sustainable development goals.

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

Challenges and Opportunities in Fintech-Driven Sustainable Finance

While fintech has brought numerous benefits to sustainable finance, it also presents several challenges that need to be addressed. One of the primary challenges is the regulatory landscape. The rapid pace of fintech innovation often outpaces regulatory frameworks, creating uncertainty and potential risks. For instance, the use of cryptocurrencies and blockchain technology in sustainable finance raises questions about compliance, security, and transparency. As these technologies continue to evolve, regulators must develop clear guidelines to ensure that fintech innovations align with sustainable finance principles and do not compromise financial stability.

Another challenge is the digital divide, which can limit access to fintech solutions in certain regions. While digital financial services have the potential to enhance financial inclusion, disparities in internet access, digital literacy, and infrastructure can hinder their adoption. To address this issue, software development companies must work closely with governments, NGOs, and other stakeholders to promote digital inclusion and ensure that fintech solutions are accessible to all. This includes developing user-friendly platforms, offering digital literacy programs, and investing in infrastructure development.

Despite these challenges, the opportunities for fintech in sustainable finance are vast. As the global demand for sustainable investment options grows, there is a significant market for innovative fintech solutions that cater to this demand. Software development companies have the opportunity to develop cutting-edge technologies that enhance transparency, accountability, and efficiency in sustainable finance. For example, advancements in AI and ML can provide more accurate assessments of ESG factors, enabling investors to make better-informed decisions. Similarly, the integration of blockchain technology can enhance the traceability and verification of sustainable financial products, building trust and confidence in the market.

Moreover, fintech innovations can support the transition to a low-carbon economy by facilitating green finance and sustainable investments. Digital platforms can connect investors with projects that promote renewable energy, energy efficiency, and sustainable infrastructure. By providing transparent and reliable information on these projects, fintech solutions can attract more capital to the green economy and accelerate the transition to a sustainable future.

The Role of Software Development Companies in Fintech and Sustainable Finance

Software development companies play a pivotal role in the intersection of fintech and sustainable finance. These companies possess the technical expertise and innovative mindset required to develop solutions that address the unique challenges of sustainable finance. By leveraging their skills in software development, data analytics, and blockchain technology, these companies create platforms that enable sustainable financial products and services.

For instance, Savvycom, a leading software development company, has been at the forefront of developing fintech solutions that promote sustainable finance. By offering tailored software solutions, Savvycom helps financial institutions, investors, and businesses integrate sustainability into their operations. Their expertise in blockchain technology, AI, and data analytics enables them to develop platforms that enhance transparency, accountability, and efficiency in sustainable finance. Whether it’s creating digital platforms for green investments, developing blockchain-based carbon trading systems, or offering data analytics tools for ESG assessments, Savvycom provides comprehensive solutions that drive positive environmental and social impact.

Looking For a Trusted Tech Partner?

We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

Frequently Asked Questions (FAQs)

How is fintech contributing to sustainable finance?

Fintech is contributing to sustainable finance by providing innovative solutions that enhance transparency, accountability, and financial inclusion. Digital platforms enable investors to access sustainable investment opportunities, while blockchain technology ensures the transparency and traceability of transactions. Additionally, fintech solutions like AI-powered data analytics tools help investors assess ESG factors, making it easier to invest in projects that align with their sustainability goals.

What are some examples of fintech innovations in sustainable finance?

Examples of fintech innovations in sustainable finance include blockchain-based platforms for carbon trading, digital investment platforms for impact investing, and AI-powered tools for assessing climate risks. These innovations have made sustainable finance more accessible, efficient, and transparent, enabling investors to support environmentally and socially responsible projects.

What challenges does fintech face in promoting sustainable finance?

Challenges in promoting sustainable finance through fintech include regulatory uncertainties, the digital divide, and the need for reliable ESG data. As fintech innovations outpace regulatory frameworks, there is a need for clear guidelines to ensure compliance and financial stability. Additionally, disparities in digital access and infrastructure can limit the adoption of fintech solutions. Addressing these challenges requires collaboration between software development companies, regulators, and other stakeholders.

How can businesses leverage fintech to achieve sustainability goals?

Businesses can leverage fintech to achieve sustainability goals by adopting digital platforms that facilitate green finance, using blockchain technology for transparent supply chain management, and utilizing data analytics tools to assess and mitigate ESG risks. By integrating fintech solutions into their operations, businesses can enhance their sustainability performance, attract socially responsible investors, and contribute to positive environmental and social outcomes.

Conclusion

In conclusion, fintech has made a significant impact on sustainable finance by advancing environmental and social goals through innovative technologies. Software development companies have played a crucial role in this transformation by developing cutting-edge solutions that enhance transparency, accountability, and financial inclusion. As the demand for sustainable financial products and services continues to grow, the role of fintech in promoting sustainable finance will become increasingly important. By leveraging technology and innovation, fintech can support the transition to a low-carbon economy, promote responsible investing, and contribute to a more sustainable future.

Savvycom offers a range of fintech solutions tailored to the needs of sustainable finance. From blockchain-based platforms to data analytics tools, Savvycom’s expertise in software development enables them to create innovative solutions that drive positive environmental and social impact. For businesses and financial institutions looking to integrate sustainability into their operations, Savvycom provides the technical expertise and industry knowledge required to develop and implement effective fintech solutions.

Tech Consulting, End-to-End Product Development, Cloud & DevOps Service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]