The Transformation of the Value Chain Through Open APIs in Banking

The financial industry has witnessed a seismic shift in recent years, driven by the rise of Open APIs in banking. These interfaces, which enable third-party developers to access a bank’s data and services, have fundamentally altered the traditional banking value chain. Historically, banks operated in closed ecosystems, serving as the primary custodians of customer data and exclusive providers of financial services. However, the introduction of open banking has disrupted this model, allowing for greater collaboration, innovation, and customer-centric solutions. This article explores the profound impact of Open APIs in banking sector, delving into the evolution of the value chain, the benefits and challenges of open banking, and the transformative potential of these technologies.

A software development company can be pivotal in this transformation by offering the expertise required to develop and integrate Open APIs in banking. For instance, Savvycom, a prominent player in the software development arena, has been instrumental in aiding banks and fintech firms to navigate the complexities of open banking. By leveraging cutting-edge technologies, Savvycom enables its clients to deliver innovative, secure, and scalable solutions that enhance customer experiences and streamline operations.

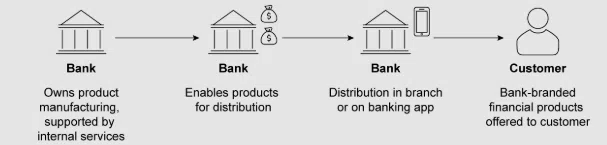

The Traditional Banking Value Chain

To fully appreciate the impact of Open APIs in banking, it is essential to understand the traditional banking value chain. In this conventional model, banks hold the primary position, managing customer data and delivering services through proprietary channels. The value chain is relatively linear, with banks providing data and functionalities—such as payments, loans, and account management—directly to customers via their digital applications. The compensation for these services typically comes from transaction fees, account maintenance fees, and other service charges.

Image source: Bain & Company

This traditional setup allows banks to maintain control over customer interactions and data. However, it also limits innovation and responsiveness to changing customer demands. The gap between customer expectations and the services provided by traditional banks has created a fertile ground for disruption by fintech companies and other non-bank players.

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

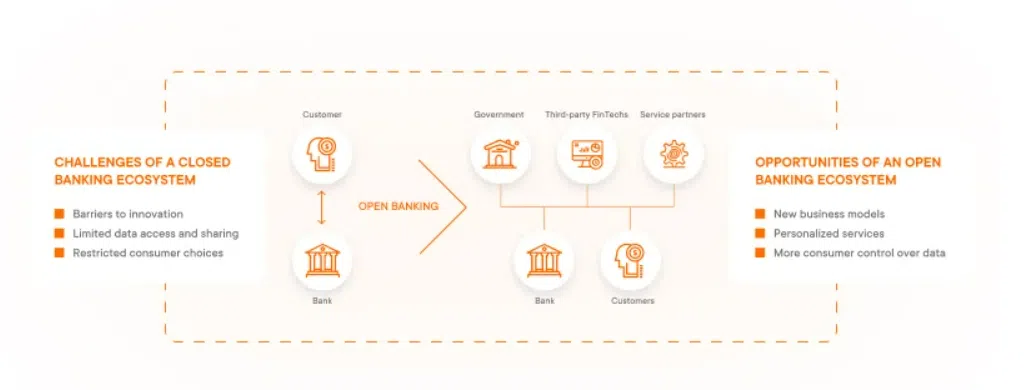

The Advent of Open Banking: A New Paradigm

The advent of open banking, enabled by Open APIs in banking, marks a significant departure from the traditional model. Open banking refers to the practice of banks opening their data and services to third-party providers through APIs. This shift allows for a more collaborative and dynamic ecosystem, where various players—banks, fintech firms, tech giants, and even non-financial entities—can co-create value.

In an open banking model, the value chain becomes more complex and interconnected. Banks, now acting as API providers, expose their data and services to third-party developers. These developers, in turn, can create new applications by integrating the bank’s APIs with other APIs and services. For instance, a fintech company might combine a bank’s payment API with APIs from other financial institutions, data providers, or even social media platforms to offer a comprehensive personal finance management tool. The value flow in this ecosystem can be visualized as follows:

Business Assets (data, functionalities) → Bank (API Provider) → API → Fintech/Third-party Developer (API Consumer) → Application → End User

This model significantly extends the value chain, creating new touchpoints and opportunities for all parties involved. According to Accenture, banks that embrace open banking could potentially increase their revenue by up to 20% by 2022. This growth is driven by new business models, such as revenue-sharing agreements with API consumers, and by tapping into new customer segments through innovative services.

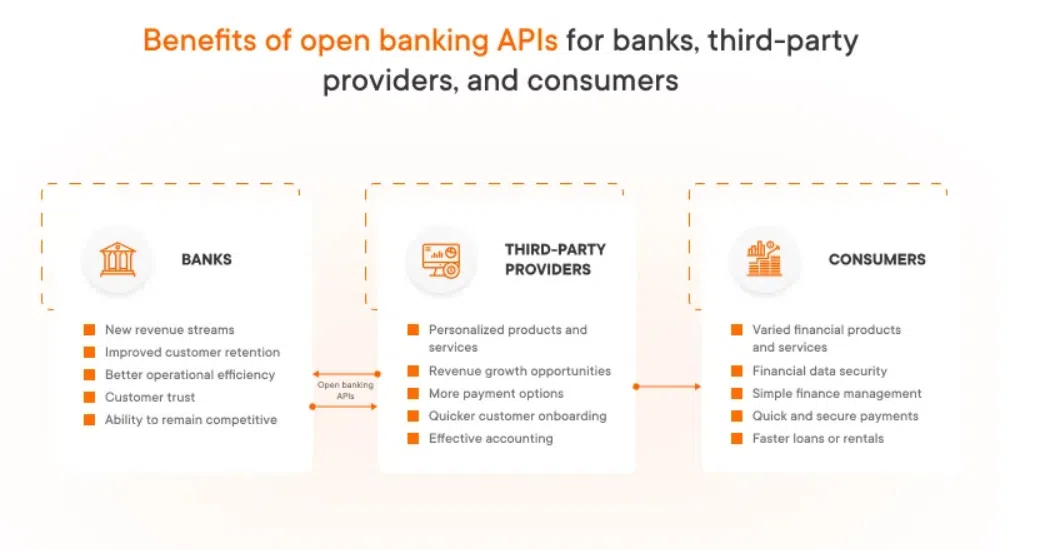

The Benefits of Open APIs in Banking

The advent of Open APIs in banking has heralded a new era of innovation, collaboration, and enhanced customer experiences. By allowing third-party developers to access and integrate a bank’s data and services, Open APIs in banking enable a seamless flow of information and functionalities across platforms. This openness fosters the creation of personalized financial solutions, streamlines operations, and introduces new revenue streams for banks. Furthermore, the competitive landscape is invigorated as financial institutions partner with fintech companies and other tech innovators, offering consumers a wider range of products and services. As the banking sector continues to evolve, the benefits of Open APIs in banking are becoming increasingly apparent, transforming the industry into a more dynamic and customer-centric ecosystem.

Image source: Yalantis

Innovation and Customer Experience

One of the most compelling benefits of open banking is the accelerated pace of innovation. By opening their data and services, banks can leverage the creativity and agility of third-party developers to quickly bring new products to market. This collaborative approach not only enhances the range of services available to customers but also improves their overall experience.

For example, consider the rise of digital wallets and payment apps. These platforms often rely on Open APIs in banking from various banks to provide seamless payment experiences. The integration of these APIs allows users to link multiple bank accounts and payment methods, manage their finances in one place, and even access value-added services like budgeting tools and loyalty programs. This level of integration and convenience was nearly impossible under the traditional banking model.

Get in touch with Savvycom for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

New Revenue Streams

Open banking also opens up new revenue streams for banks. By acting as API providers, banks can monetize their data and services in several ways. They can charge third-party developers for API access, enter into revenue-sharing agreements, or offer premium APIs with advanced features for a fee. According to a report by Juniper Research, the global market for Open APIs in banking is expected to surpass $720 billion by 2029. This growth highlights the lucrative potential of APIs as a new business line for banks.

Enhanced Collaboration and Ecosystem Development

Another significant benefit of open banking is the potential for enhanced collaboration. Banks can form strategic partnerships with fintech firms, tech companies, and even non-financial organizations to co-create value. For example, a bank might partner with an e-commerce platform to offer embedded financing options at checkout, leveraging the bank’s lending API. This type of collaboration can help banks reach new customer segments and offer more relevant services, thereby driving growth and customer loyalty.

Challenges and Considerations

While the benefits of open banking are substantial, the transition to an open ecosystem is not without challenges. Banks must navigate a complex landscape of technical, regulatory, and strategic considerations to successfully implement Open APIs in banking.

Image source: Yalantis

Security and Privacy Concerns

One of the most pressing challenges is ensuring the security and privacy of customer data. Open APIs in banking inherently involve sharing data with external parties, which increases the risk of data breaches and unauthorized access. Banks must implement robust security measures, such as encryption, tokenization, and access controls, to protect their APIs. According to a report by IBM, the average cost of a data breach in the financial sector is $5.85 million, underscoring the importance of robust security protocols.

Moreover, banks must comply with data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States. These regulations impose strict requirements on data handling, transparency, and customer consent, adding an additional layer of complexity to open banking initiatives.

Technical and Operational Challenges

Implementing Open APIs in banking requires significant technical expertise and investment. Banks must develop and maintain API gateways, manage API documentation, and provide developer support. Additionally, they must ensure the scalability and reliability of their APIs, as outages or performance issues can damage customer trust and hinder adoption.

Furthermore, banks must navigate the challenges of legacy systems and infrastructure. Many traditional banks still operate on outdated core banking systems that may not be compatible with modern API standards. According to a survey by Accenture, 56% of banks cite legacy systems as a barrier to open banking adoption. To overcome this challenge, banks may need to invest in modernization efforts, such as migrating to cloud-based platforms or adopting microservices architectures.

Strategic and Cultural Shifts

Open banking represents a significant strategic and cultural shift for traditional banks. Historically, banks have been protective of their data and cautious about collaborating with external entities. However, open banking requires a more open and collaborative mindset, as well as a willingness to share data and co-create value with partners.

Banks must also rethink their business models and revenue streams. In the traditional model, banks generate revenue primarily from fees and interest income. In the open banking model, banks may need to explore new monetization strategies, such as subscription-based APIs or data analytics services. This shift requires banks to develop new capabilities, such as API marketing and partnership management, and to foster a culture of innovation and experimentation.

Looking For a Trusted Tech Partner?

We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

Case Studies: Real-World Applications of Open APIs in Banking

To illustrate the transformative potential of Open APIs in banking, let’s examine a few case studies of successful implementations:

BBVA’s API Market

BBVA, a leading global bank, has been at the forefront of open banking with its API Market platform. Launched in 2017, the platform offers a suite of APIs that third-party developers can use to access a range of BBVA’s services, including payments, identity verification, and account information. BBVA’s open banking initiative has enabled the bank to partner with fintech firms and other tech companies, fostering a vibrant ecosystem of innovative solutions.

One notable example is BBVA’s collaboration with Uber. By integrating BBVA’s payment APIs, Uber has been able to offer in-app payment options to its customers in Mexico, streamlining the payment process and enhancing the user experience. This partnership has not only improved customer satisfaction but also generated new revenue streams for both companies.

Fidor Bank’s Open Banking Platform

Fidor Bank, a digital-only bank based in Germany, has built a fully open banking platform that allows third-party developers to access its APIs and create new financial services. Fidor’s platform supports a wide range of use cases, from personal finance management to cryptocurrency trading. The bank’s open approach has attracted a diverse range of partners, helping Fidor expand its customer base and enhance its offerings.

For example, Fidor has partnered with the cryptocurrency exchange Kraken to offer seamless integration between Fidor’s banking services and Kraken’s trading platform. This partnership allows Fidor customers to buy, sell, and hold cryptocurrencies directly from their Fidor accounts, providing a unique value proposition in the market.

Plaid’s API Aggregation

Plaid, a leading fintech company, provides a suite of APIs that aggregate financial data from various sources, including banks, credit card providers, and investment platforms. Plaid’s APIs enable developers to build applications that offer users a unified view of their financial data, regardless of where their accounts are held. Plaid’s technology powers popular apps like Venmo, Robinhood, and Acorns, helping millions of users manage their finances more effectively.

Plaid’s success highlights the power of API aggregation in open banking. By aggregating data from multiple sources, Plaid enables a wide range of use cases, from budgeting tools to investment tracking. The company’s APIs have also helped banks and fintech firms to innovate and deliver new services to their customers, furthering the adoption of open banking.

The Future of Open APIs in Banking

The future of open banking is bright, with the potential for continued growth and innovation. As more banks embrace open banking and develop API strategies, the ecosystem of third-party developers, fintech firms, and tech companies is likely to expand. This growth will drive further innovation, as new players enter the market and existing players develop new solutions.

In the coming years, we can expect to see increased collaboration between banks and non-financial entities, such as retail companies and tech giants. These partnerships will create new opportunities for cross-industry innovation, as companies leverage their complementary strengths to deliver more holistic and integrated services.

Moreover, advancements in technologies such as artificial intelligence (AI), machine learning, and blockchain will further enhance the capabilities of open banking platforms. For instance, AI-powered APIs could provide more personalized financial advice, while blockchain-based APIs could enable more secure and transparent transactions.

However, the success of open banking will also depend on the regulatory landscape. Policymakers around the world are grappling with the challenges and opportunities presented by open banking, and their decisions will shape the future of the industry. Regulatory frameworks that encourage innovation while ensuring security and consumer protection will be crucial in fostering a thriving open banking ecosystem.

Frequently Asked Questions

How do Open APIs benefit banks?

Open APIs benefit banks by fostering innovation, enabling new business models, and expanding their market reach. By collaborating with third-party developers, banks can offer more diverse and personalized services to their customers.

What are the security concerns with Open APIs?

The primary security concerns with Open APIs include data privacy, unauthorized access, and potential breaches. Banks must implement robust security measures, such as encryption and access controls, to protect their APIs and customer data.

Can traditional banks adopt Open APIs?

Yes, traditional banks can adopt Open APIs to stay competitive in the digital age. By embracing open banking, they can collaborate with fintech companies, enhance their digital offerings, and meet the evolving needs of their customers.

How do Open APIs impact customer experience?

Open APIs improve customer experience by offering more integrated and personalized services. They enable customers to access a broader range of financial products through a single app, providing a seamless and convenient experience.

Conclusion

In conclusion, Open APIs in banking have revolutionized the traditional banking value chain, ushering in a new era of collaboration, innovation, and customer-centric solutions. By enabling third-party developers to access their data and services, banks can unlock new revenue streams, enhance customer experiences, and drive growth. However, the transition to open banking also presents challenges, including security and privacy concerns, technical and operational hurdles, and the need for strategic and cultural shifts.

As the industry continues to evolve, banks, fintech firms, and tech companies must navigate these challenges and seize the opportunities presented by open banking. With the right strategies and partnerships, they can create a more open, inclusive, and innovative financial ecosystem that benefits all stakeholders.

Savvycom is a key player in this transformation, providing the technical expertise and solutions that banks need to succeed in the open API ecosystem. With a focus on cutting-edge technologies and a deep understanding of the banking industry, Savvycom helps banks navigate the complexities of open banking, ensuring they can capitalize on the opportunities it presents. As the industry continues to evolve, partnering with a software development company like Savvycom will be essential for banks looking to stay ahead of the curve.

Tech Consulting, End-to-End Product Development, Cloud & DevOps Service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]