How To Build Financial Software: 2026’s Ultimate Guide

Fintech (financial technology) represents a significant and rapidly growing market, characterized by numerous new startups emerging each year. However, for startups, the challenge lies in understanding how to build financial software that aligns with their ideas and meets the demands of their target markets. We recognize the complexities of this endeavor, and it is our pleasure to provide guidance on all aspects related to identifying and constructing financial software. The contents of this article aim to provide you with an overview of this field. Let us begin!

What is financial software?

Financial software, also referred to as financial system software, serves as a specialized toolset aimed at streamlining and managing monetary activities across businesses, organizations, and personal finances. These solutions encompass a diverse array of functionalities, ranging from accounting systems and payment gateways to budgeting apps and financial forecasting tools.

By automating tasks and facilitating transactions, financial software significantly enhances efficiency and ensures accurate financial reporting. It empowers users to track expenditures, monitor revenues, manage budgets, and adhere to regulatory requirements, fostering financial transparency and accountability. As digitalization gains momentum, the demand for robust financial software grows, spurring innovation and evolution in the fintech industry.

We take pride in being one of the foremost software development companies and IT outsourcing services in the ASEAN region. Savvycom offers comprehensive assistance for your business in planning and developing financial analysis software solutions, all without the burden of excessive costs. Share your ideas with us today, and let’s work together to bring them to fruition! Feel free to reach out to us for further consultation today!

Who needs financial software?

Financial software is essential not only for finance experts or big companies but for a wide range of users. Individuals and families can use it to manage budgets and track expenses, gaining better financial control.

Small businesses and freelancers can benefit from features such as invoicing, tax preparation, and payroll management, which simplify finance tasks. Large corporations can utilize financial reporting software for detailed financial analysis and forecasting, aiding strategic decision-making.”+

Non-profit organizations can also benefit from financial software by simplifying donation tracking and fund allocation, ensuring transparency and accountability. Financial advisors and accountants can streamline operations, enhance client service, and ensure regulatory compliance with advanced financial software. For instance, CRM for financial advisors enables personalized client relationship management, helping advisors track interactions, manage portfolios, and deliver tailored financial guidance efficiently. In essence, almost anyone dealing with finances – which includes most of us – can benefit from using financial software in some capacity.

Importance of financial application development?

Financial software simplifies complex problems for individuals and businesses

Financial application development involves creating software that helps individuals or organizations manage, track, and analyze their finances. There are several reasons why it’s important:

- Audience: These applications serve different types of users like individuals, small businesses, large corporations, banks, or governments. Each group has unique needs, and financial apps offer tailored solutions.

- Process: Development includes planning, designing, coding, testing, deploying, and maintaining. Attention to detail, quality, and security is vital due to the sensitive data involved. Compliance with laws and regulations, like data protection and accounting standards, is necessary.

- Benefits: Financial apps improve efficiency, accuracy, security, and decision-making for users. They enhance user experience, satisfaction, and loyalty while boosting revenue and profitability.

In essence, financial application development is a crucial task demanding expertise, creativity, and innovation.

Types of financial software

There’s a variety of financial software available, offering businesses and individuals numerous choices. However, not all software enjoys widespread popularity. Let’s summarize and analyze some of the popular styles that garner high traffic and usage.

1. Accounting systems

Accounting systems are vital for effectively managing financial operations. They come in various forms, each tailored to specific business requirements:

- General Accounting Software: This software records and processes financial transactions such as invoices, payments, and expenses. It generates detailed reports and statements to evaluate a business’s financial status.

- Enterprise Resource Planning (ERP) Software: Financial planning software systems integrate different business functions like accounting, human resources, and inventory management. They offer a centralized platform to streamline operations and facilitate decision-making.

- Payroll Software: Designed to handle employee payroll, this software automates payroll processing, tracks work hours, and ensures compliance with tax regulations. ADP stands out as a notable example in this field.

- Billing and Invoicing Software: It will simplify the management of payable and receivable accounts by automating tasks and minimizing errors associated with manual data entry.

- Inventory Management Software: These systems help businesses monitor inventory levels, orders, and deliveries, optimizing stock control and cutting costs.

These software solutions cater to businesses of all sizes, enhancing efficiency, accuracy, and transparency in financial management.

2. Payments gateway

Payment gateways are crucial middlemen in online transactions, making it easy to process payments using credit and debit cards. They securely connect merchant and customer bank accounts, verifying banking and card details, ensuring enough funds, and transferring data between banks for safe transactions.

It’s impressive how payment gateways smoothly integrate with various software platforms for online payments, showing their flexibility. The global payment gateway market, valued at $32.52 billion in 2023, has grown steadily at a rate of 22.2%, highlighting their vital role in digital payment commerce.

Savvycom, a trusted provider in designing and providing finance solutions

In addition, financial software development companies like Savvycom that offer financial software development services, lead the way in payment processing, using technology and adaptability to navigate the changing landscape of online business. The shift to online commerce due to the pandemic has pushed payment gateways even further into the spotlight of FinTech innovation, confirming their importance in modern financial systems.

3. Insurance

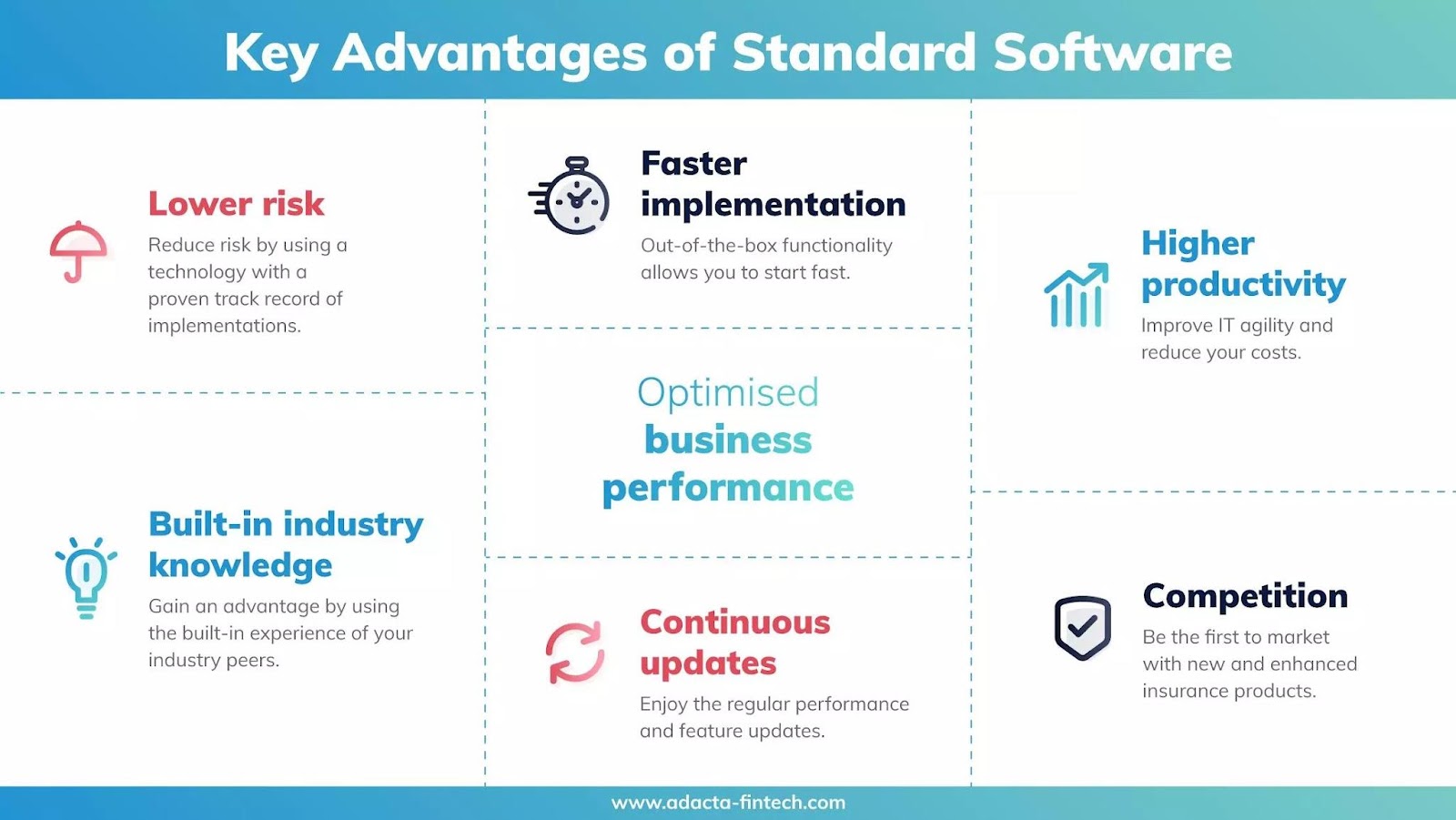

Insurance technology (InsureTech) is among the fastest-growing segments in financial applications, with an impressive Compound Annual Growth Rate (CAGR) of 34.4% and a projected value of $1.19 billion by 2027. The evolution of InsureTech has brought about a new wave of innovation, where data from wearables and similar devices play a crucial role in providing highly personalized services. This new generation of InsureTech platforms utilizes wearable data to offer dynamic insurance plans and personalized recommendations to customers.

The insurance software market remains a valuable opportunity for businesses

Source: Adaca fintech

Interestingly, smaller insurance companies are embracing this trend, venturing into areas that larger peers traditionally avoided. In doing so, these smaller firms not only explore new opportunities but also reduce customer acquisition costs, thereby enhancing their competitiveness in the market.

4. P2P lending platforms

Peer-to-peer (P2P) lending platforms mark a significant shift in borrowing and lending, allowing individuals to borrow directly from others in a virtual marketplace. These platforms, driven by decentralization, connect borrowers with investors without traditional financial intermediaries. P2P lending platforms prioritize reducing operational costs, offering more attractive terms to investors than traditional banks.

According to Webisoft, the global P2P lending market is expected to reach $558.91 billion by 2027, with a growth rate of 29.7%, driven in part by pandemic-related challenges. As more companies adopt P2P lending, these platforms transform lending practices, making capital more accessible and promoting decentralized borrowing and lending.

Development cost?

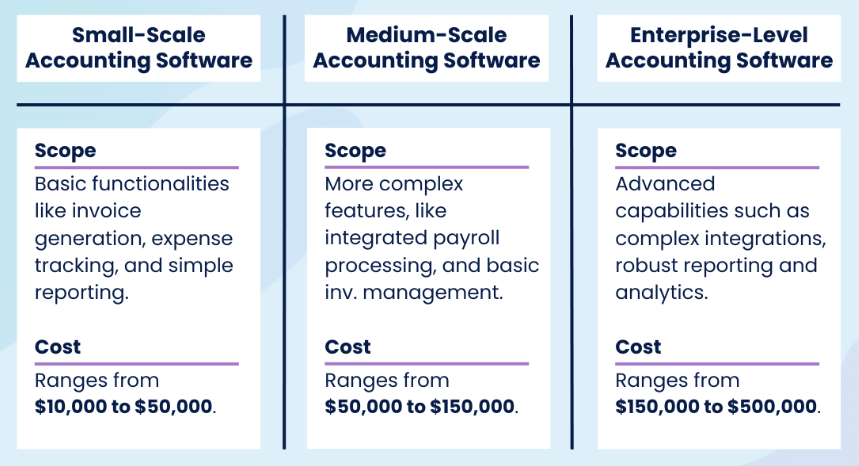

Understanding the cost dynamics of financial software development involves considering various critical factors and estimation methodologies. The development cost is influenced by factors such as scope, complexity, technology stack, and human resources. These elements collectively determine the overall expenses of building software solutions.

Latest price list on costs of building financial software

Estimating development costs entails analyzing project scope, complexity, and technology resources needed. Techniques like bottom-up estimation and analogous estimation help derive accurate cost projections. These methods take into account project size, duration, and required functionalities to establish a realistic budget framework.

For small-scale accounting software projects, costs typically range from $10,000 to $50,000, depending on project size and duration. Medium-scale projects may incur expenses ranging from $50,000 to $150.000, considering complexity and required features. Large-scale or enterprise-level accounting software development may involve significantly higher costs due to extensive integrations, scalability, and maintenance requirements.

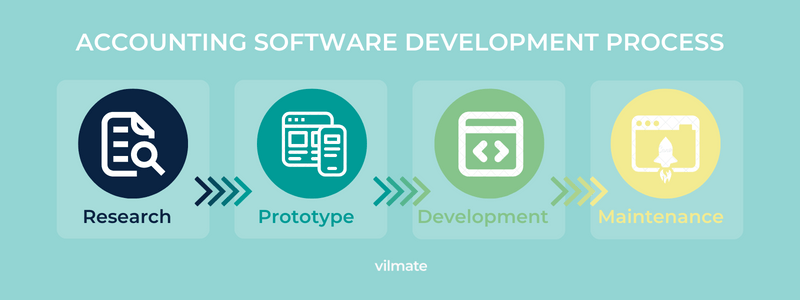

How to build financial software?

Quick steps to build financial software

Building financial software requires careful planning and execution to make sure it works well and is dependable. Here’s a clear plan to help you through the development process:

- Define Project Requirements: Start by understanding what your financial software needs to do. Think about things like managing accounts, processing transactions, generating reports, and keeping things secure.

- Market Research: Look closely at what users want, what your competitors are offering, and where the industry is heading. Find out what’s missing in current solutions so you can make your software fit the market better.

- Select Technology Stack: Choose the right tools and frameworks based on what your project needs and how big you expect it to get. Think about security, speed, and making sure it can grow with updates.

- Design Architecture: Create a strong plan for how everything in your software will fit together. Decide how data will be organized, what different parts of the system will do, and how new features can be added later on.

- Develop Core Features: Start building the most important parts first, like letting users log in, managing accounts, and handling transactions. Put the most useful things first, based on what users need and what’s standard in the industry.

- Implement Security Measures: Make sure your software keeps financial data safe from hackers and other threats. Use encryption, special logins, and check regularly to make sure everything stays secure.

- Test and Quality Assurance: Check your software thoroughly to find and fix any problems. Test how it works, how different parts fit together, and how secure it is to make sure users have a smooth experience.

- Deployment and Maintenance: Once your software is ready, launch it in a controlled way and keep an eye on how it performs. Keep updating and fixing it to make sure it keeps working well and meets users’ changing needs.

By following these steps, you can create financial software that’s reliable and meets the needs of users and the industry.

Conclusion

In summary, creating financial software is a strategic investment for organizations, enabling precise financial management and decision-making. The process, from planning to implementation, demands a focused approach to ensure that the software aligns with specific business needs and offers a secure, scalable, and efficient financial management solution. Ultimately, we hope the question “how to build financial software?” was clear for you.

Unlocking Digital Potential: Financial software, App Development, Cloud & DevOps Services and more! Since 2009, Savvycom has been at the forefront of leveraging digital technologies to empower businesses, mid and large enterprises, and startups across diverse industries. As a software development firm, let us guide you in crafting top-notch software solutions and products while offering an array of professional services tailored to your needs…

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]