10 Best Financial Risk Management Software In 2025

Before earning a profit, learning financial risk management is a must. An excellent investor determines future objectives with a clear vision of potential risks. With technological developments, financial risk management software is popularized, simplifying the analysis and enhancing ROI greatly. Partnering with a reputable financial software development company can ensure the creation of tailored solutions for efficient financial risk management.

What Is Financial Risk Management?

“Financial risk management is the practice of protecting economic value in a firm by using financial instruments to manage exposure to risk. Similar to general risk management, financial risk management requires identifying its sources, measuring them, and plans to address them. Financial risk management can be qualitative and quantitative. As a specialization of risk management, financial risk management focuses on when and how to hedge using financial instruments to manage costly exposures to risk.” – Wikipedia

To make it simple, financial risk management is minimizing risk negative impacts on assets by appropriate financial. instruments

Features of Financial Risk Management Software

The various financial risk management software offers a wide array of features designed to help organizations manage risk effectively. Key features include:

| Key Feature | Description |

|---|---|

| Treasury Management | Tools for overseeing liquidity, cash flow, and funding needs. |

| Risk Analytics | Comprehensive analysis of various risk factors to inform decision-making. |

| Portfolio Management | Tools for optimizing investment portfolios and allocation strategies. |

| Fraud Detection | Mechanisms for identifying and mitigating fraudulent activities. |

| Credit Risk Management | Features that evaluate and manage credit exposure. |

| Market Risk Analysis | Tools to assess risks arising from market fluctuations. |

| Liquidity Risk Management | Techniques for analyzing liquidity positions and requirements. |

| Compliance Management | Features that ensure adherence to regulatory requirements. |

| Reporting | Robust reporting tools that provide insights and metrics on risk management processes. |

| Stress Testing | Capabilities to simulate adverse conditions and their impact on financial performance. |

| Cash Management | Tools for managing short-term liquidity and cash flow effectively. |

| Hedge Accounting | Features to support hedging strategies and ensure compliance with accounting standards. |

10 Best Financial Risk Management Software In 2025

01. Kyriba

Kyriba empowers financial leaders and their teams to manage liquidity, generate value while shielding financial risks. Internal applications for treasury, risk, payments, and working capital, with vital external sources such as banks, ERPs, trading platforms, and market data providers are all connected by Kyriba’s pioneering Active Liquidity Network. Based on a highly secure, 100% SaaS enterprise platform, Kyriba delivers superior bank connectivity and a seamlessly integrated solution set for handling complex financial challenges. Kyriba has become the go-to financial risk management software provider for thousands of companies, including many of the world’s largest organizations in New York, Shanghai, London, Singapore, Tokyo, Paris, and many more. The software is supported in Arabic, English, French, German, Spanish, Italian, Chinese, Polish, Portuguese, Japanese, Russian, Romanian, and Serbian.

Main features:

- Treasury Management

- Fraud Detection

- Risk Management

- Supply Chain Finance

- Payments

02. Murex

Murex’s MX.3 shortens the gap between the capital market operators and financial risk management software systems. The platform enables financial services firms to participate in capital markets and efficiently manage the credit, liquidity risk, and market across all asset classes despite complex and far-reaching regulatory requirements, offering cutting-edge risk solutions.

The software can deal across numerous asset instruments and classes, making it flexible and easily integrated within existing IT and risk infrastructure institutions.

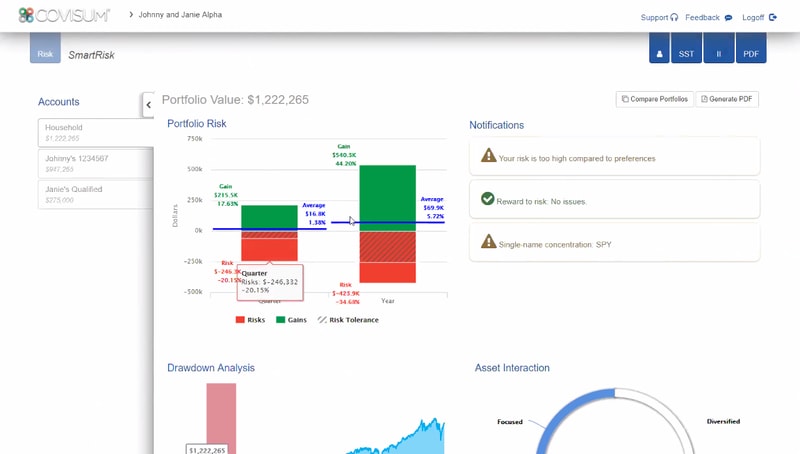

03. SmartRisk

SmartRisk is a financial risk management software tool specially designed to support financial advisors in analyzing portfolio risk to motivate clients to make portfolio changes, retain clients during a down market, and prevent clients from making investment mistakes. Clients are often not sensitive to market risk and don’t have precise downside expectations either too conservative or too reckless, resulting in inaccurate investment allocations. SmartRisk empowers advisors to communicate efficiently with clients to avoid investment mistakes.

Main Features:

- Portfolio Modeling

- Reporting

- Risk Analytics

- Market Risk Management

- Portfolio Management

- Portfolio Modeling

- Reporting

- Risk Analytics

- Stress Tests

04. FactSet

FactSet is the financial risk management software focusing on time-management problems. The platform is equipped with multi-asset class portfolio analytics, saving advisors time in managing data. With advanced portfolio analytics, performance, and attribution, clients get an unparalleled combination of portfolio equity and fixed income analytics, data concordance management, workflow capabilities, and data distribution for internal and external clients.

Main Features:

- Portfolio Analytics:

- Performance & Attribution

- Connected Teams

- Unique Content

- Performance Drivers

- Flexible Reports

- Risk Analytics:

- Optimized Portfolios

- Risk Models

- Risk Over Time

- Connected Teams

- Stress Testing

- Quantitative Research:

- Portfolio Simulation

- Backtesting

- Data Exploration

- Characteristics Analysis

- Portfolio Optimization

- Performance Measurement & Attribution:

- Returns Analysis

- Relative & Absolute Performance

- Integrated Data

- Reporting & Distribution

- Attribution Models

- GIPS Compliance

- Client & Portfolio Reporting:

- Consistent Branding

- Trusted Analytics

- Commentary in Seconds

- End-to-End Reporting

- User-Empowered or Managed Services

- Oversight and Approvals

05. Calypso

Calypso delivers cross-asset solutions for trading, risk, processing, control derivatives, treasury and securities systems. The users of Calypso include sell-side financial institutions such as banks and prime brokers, buy-side firms such as investment managers, asset managers, hedge funds, family offices, insurers and corporations, as well as treasury services providers including exchanges, clearers and service consortiums.

Main features:

- Compliance Management

- Credit Risk Management

- For Hedge Funds

- Liquidity Analysis

- Market Risk Management

- Operational Risk Management

- Portfolio Management

- Reporting

- Risk Analytics

06. FINCAD

FINCAD is an integrated multi-asset portfolio and financial risk management software company. The platform is transparent with comprehensive cross-asset coverage and documentation of all models, calculation methodologies, and references. The clients of the software include firms such as investment managers, asset managers, hedge funds, pension funds, banks, auditors, insurers and corporations. With various tools, FINCAD enables financial firms to manage risk while complying with sophisticated regulations.

Main features:

- Portfolio management

- Portfolio analysis

07. GTreasury

GTreasury is a platform that gives firms cloud access to an end-to-end workflow for integrated treasury management and financial risk management solutions and services. Its single database, connectivity, and workflow unify technology and make working smarter. GTreasury offers a SaaS solution that can integrate Payments, Cash Management, Financial Instruments, Banking, Accounting, Risk Management, and Hedge Accounting.

Main features of this risk management product:

- Cash Management

- Financial Instruments

- Banking

- Accounting

- Funds Transfers

- SaaS & Installed Platforms

- Illuminating Liquidity

- Treasury

- Treasury Management

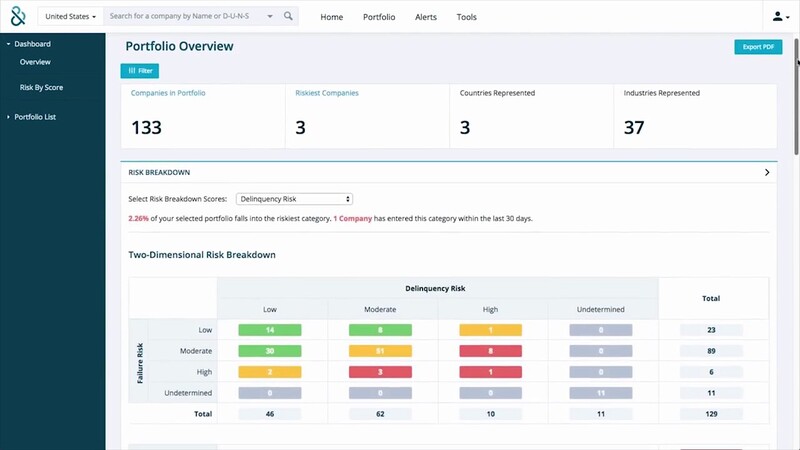

08. D&B Credit

D&B Credit is a cloud-based financial risk management software powered by Dun & Bradstreet’s industry-leading data and analytics. Finance and credit professionals can function more effectively and drive sustainable and profitable growth with the help of powerful portfolio segmentation tools, configurable alert tracking, and easy-to-read digital credit reports. The system supports multiple languages, currencies, and provides customizable views and tagging options to flexibly manage customer portfolios.

“That recommended credit limit is paramount to us…I love the way that the data flows.” Paul Laska, Credit Manager, A.N. Deringer reviews on D&B Credit website.

09. MetricStream

MetricStream is a leading provider of enterprise and cloud applications for governance, risk, and compliance (GRC). M7 Operational Risk Management is a popular system developed by the company, supplying numerous tools to establish efficient operational risk management within their financial risk management software. The system is easily integrated into users’ companies’ risk management processes to enhance financial performance, protect investment capitals, and equity.

“We’ve successfully rolled the tool out to all 3 lines of defense and are overall pleased with the realized value. Through MetricStream we’ve also purchased additional Tableau licenses, which allows us to manipulate, analyze, and present the data in ways that we weren’t capable of pre-MetricStream and common GRC framework.” – Reviewed by a Risk Analyst on Gartner

10. Reval

Reval is a leading treasury and financial risk management platform, including managing cash, liquidity, and financial risk through its cloud-based offerings, helping clients with their usage of financial instruments and hedging activities. Thanks to the cloud platform, clients can optimize operational efficiency, security, control, and compliance, enhancing the overall performance.

Main features:

- Risk Management

- Hedge Accounting And Compliance

- Cash And Liquidity Management

- Treasury Management System

- SaaS

Additionally, the rise of the financial super app concept is reshaping the landscape, allowing users to access multiple financial services within a single platform. This addresses a growing need for integrated financial solutions and is particularly relevant among users seeking a comprehensive overview of their financial health.

The selection of the right financial app development companies can significantly impact the success of such initiatives, as these firms possess the expertise and technical skill to create versatile apps that cater to various financial needs.

Savvycom – Your Trusted Tech Partner

Savvycom offers expertise in tech consulting, end-to-end product development, and software outsourcing, utilizing digital technologies to drive business growth across industries. With a focus on delivering high-quality software solutions and products, we provide a wide range of related professional software development services tailored to your specific requirements.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: [email protected]

How often should risk assessments be performed?

Risk assessments should be performed regularly and whenever significant changes occur within a business or its external environment. Typically, businesses conduct these assessments annually, but more frequent assessments may be necessary in rapidly changing markets or industries.

Additionally, it's crucial to reassess risks when introducing new products or services, entering new markets, or experiencing major organizational changes, This ensures that all potential risks are identified and managed effectively.