Mastering Credit Risk Management in Banks: Strategies for Success

In today’s rapidly evolving financial landscape, credit risk management in banks is more critical than ever. Financial institutions face challenges such as fluctuating economies, regulatory changes, and emerging market demands, making robust risk management practices essential. As a software development company, we understand the role of technology in reshaping these strategies. Let’s dive into effective approaches and the tools available for mastering credit risk management in banks.

Understanding Credit Risk Management in Banks

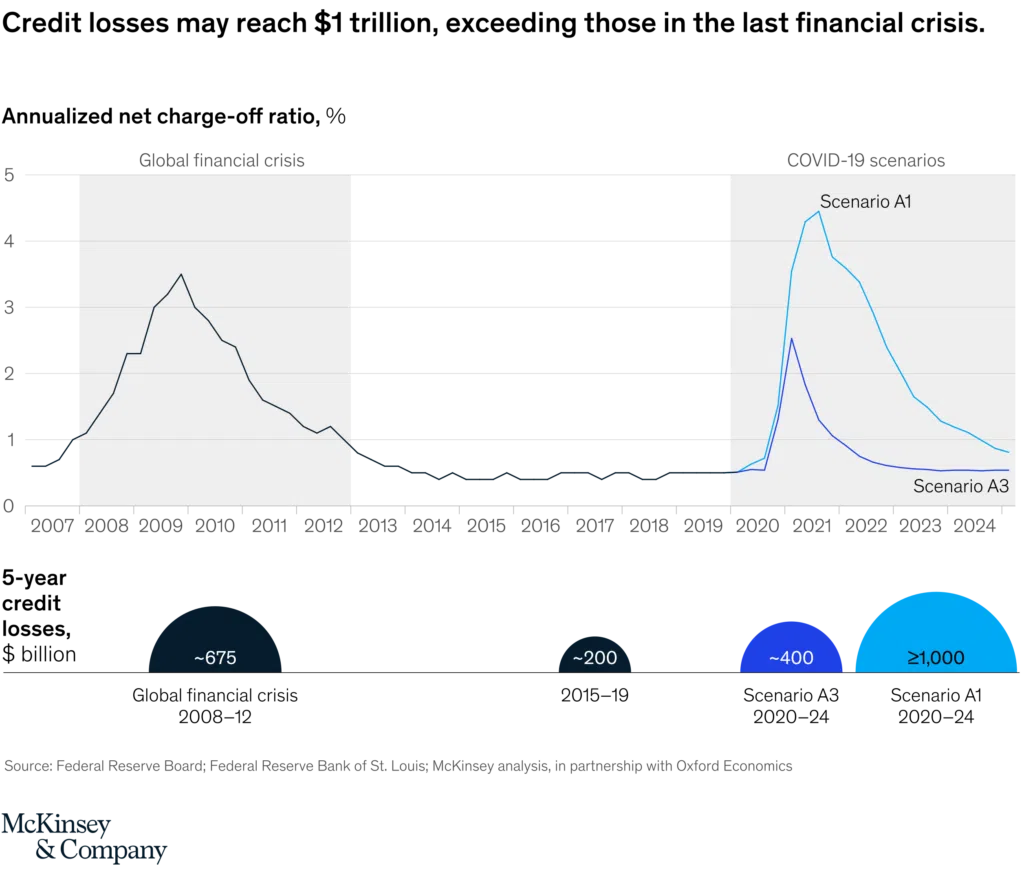

McKinsey & Company reports that global credit losses reached $1 trillion in 2024, emphasizing the need for robust risk management systems.

Image source: McKinsey & Company

Credit risk in banks refers to the potential for a borrower to fail to meet financial obligations. Effective credit risk management in banks involves identifying, measuring, monitoring, and mitigating these risks. By implementing sound risk management, banks can ensure financial stability, protect their customer base, and comply with regulatory demands.

Key Objectives:

-

Assessing Borrower Risk: Leveraging credit scoring systems, historical data, and predictive analytics to evaluate borrower creditworthiness effectively. This process minimizes the likelihood of defaults and enhances decision-making accuracy.

-

Portfolio Diversification: Mitigating risk exposure by distributing assets across various sectors, industries, and geographies. Diversification acts as a safeguard against economic downturns in specific areas.

-

Regulatory Compliance: Aligning operations with global standards such as Basel III, which emphasizes capital adequacy, stress testing, and market discipline to strengthen financial systems.

-

Improving Decision-Making: Harnessing the power of data analytics and machine learning to make faster, more informed lending decisions that enhance overall efficiency and accuracy.

Effective credit risk management serves as a foundation for sustainable banking practices, enabling institutions to navigate complex financial landscapes while fostering trust among stakeholders.

Looking For a Trusted Tech Partner?

We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

Strategies for Effective Credit Risk Management

Best practices in credit risk management help banks and financial institutions minimize potential risks and maintain financial stability. These practices encompass a combination of credit risk assessment, policies, and monitoring strategies, including:

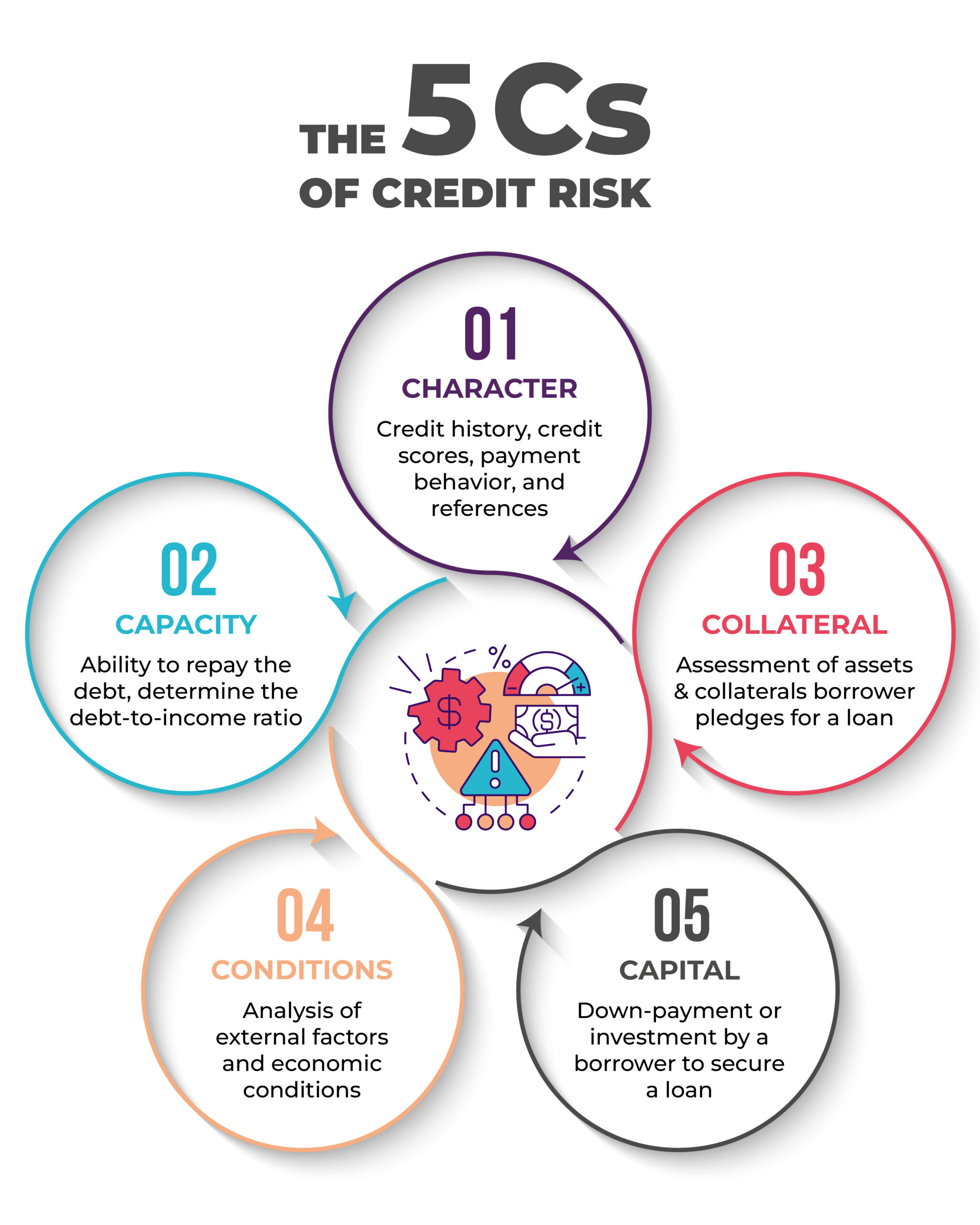

5Cs of Credit Risk

The 5Cs of credit risk provide banks and lending institutions a framework to identify the inherent risks in lending and mitigate credit risks. The 5Cs are:

- Character: Evaluates counterparty’s or borrower’s credit history, credit scores, payment behavior, and references

- Capacity: Assessment to determine the ability to repay the debt and ascertain the debt-to-income ratio

- Collateral: Evaluation of assets & collaterals borrower pledges for a loan, essential for credit risk mitigation

- Conditions: Analysis of external factors and economic conditions that may impact the loan terms and borrower’s ability to repay.

- Capital: It is the down payment or investment done by a borrower to secure a loan. This helps banks mitigate credit risk in case of a default.

Iamge source: Anaptyss

Advanced Data Analytics

Banks increasingly rely on advanced data analytics to predict potential credit risks. Machine learning (ML) algorithms and artificial intelligence (AI) tools analyze large datasets, uncovering patterns and anomalies that traditional models may overlook. AI-powered credit scoring models, for instance, offer more accurate borrower assessments. A McKinsey report highlights the benefits of data-driven approaches, noting that banks leveraging these methods have experienced a 20% reduction in credit losses.

Automation in Credit Assessment

Automation has transformed credit assessment processes, reducing human error and accelerating decision-making. Tasks such as loan application reviews and credit scoring are now automated, ensuring consistency and efficiency. Automated underwriting systems and robotic process automation (RPA) are prime examples of tools that streamline workflows. A mid-sized European bank, for instance, achieved a 40% reduction in loan processing time by integrating RPA into their operations.

Enhanced Risk Monitoring Systems

Real-time monitoring tools are vital for providing actionable insights. These systems track market conditions, borrower behavior, and macroeconomic trends, enabling banks to address potential risks proactively. Integration of real-time dashboards and alerts allows institutions to stay ahead of potential challenges. According to a PwC report, real-time monitoring systems have been shown to reduce non-performing loans by 15%, demonstrating their effectiveness in improving financial outcomes.

Technology Integration

Modern technology such as blockchain, cloud computing, and big data plays a significant role in enhancing credit risk management. Blockchain ensures secure and immutable transaction records, while cloud solutions provide scalable platforms for risk analysis. Big data supports predictive modeling and trend analysis, offering banks the tools to manage credit risks comprehensively and efficiently.

Regulatory Technology (RegTech)

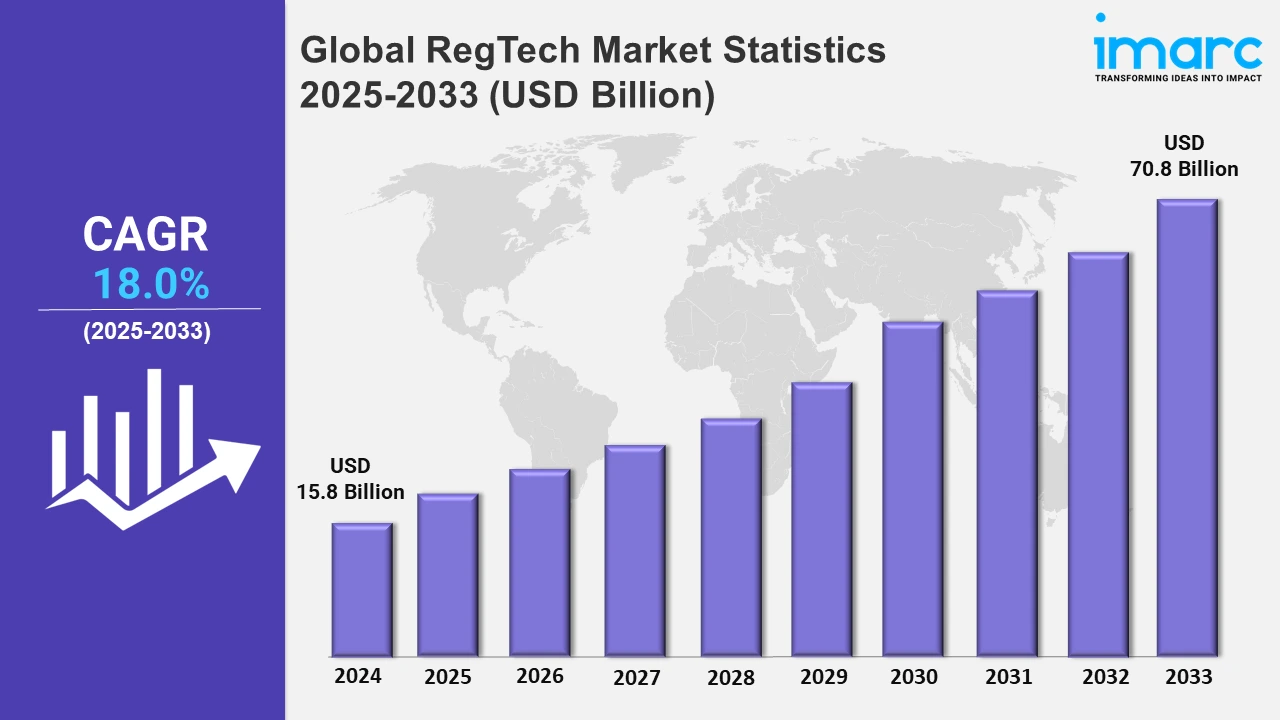

Compliance remains a critical component of credit risk management in banks. RegTech solutions automate compliance processes, ensuring adherence to international and local regulations. These tools validate credit limits and borrower profiles against regulatory requirements in real time. The global RegTech market is projected to reach $70.8 billion by 2033, underlining its growing importance in the banking sector.

Image source: imarc

Portfolio Diversification

Portfolio diversification remains a cornerstone of effective credit risk management in banks. By spreading investments across various sectors and geographies, banks can reduce their exposure to sector-specific downturns. Simulation tools allow institutions to evaluate potential risks under different economic scenarios. For example, a U.S.-based bank successfully reduced sectoral risk by 30% through targeted diversification efforts.

Tools That Can Use to Improve Credit Risk Management in Banks

Analytics

Advanced analytics provide banks with deeper insights into borrower behavior, enabling more accurate creditworthiness assessments. These tools also help identify early warning signs of financial distress or fraudulent activities, equipping institutions to take proactive measures.

Automation

Automation has become indispensable for streamlining the assessment of loan applications, credit scoring, and ongoing monitoring. By enabling faster and more consistent decision-making, automation ensures that banks can identify and manage credit risks more effectively and efficiently.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML offer powerful capabilities for analyzing vast datasets and identifying patterns in borrower behavior. These technologies support the development of AI-driven credit scoring models that consider a wide range of variables, providing a comprehensive view of an applicant’s creditworthiness. ML algorithms continuously monitor and adapt to changing borrower behaviors, helping institutions detect early signs of financial distress and manage risks proactively.

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

Credit Risk Modeling Software

Predictive modeling software enables banks to anticipate potential losses and make data-driven decisions. This technology is essential for developing strategies that address specific credit risks and ensure long-term stability.

Collateral Valuation Tools

For secured loans, accurate valuation of collateral is critical. Collateral valuation tools provide banks with reliable assessments of asset value, helping to gauge the impact of collateral on credit risk.

Stress Testing Software

Stress testing tools simulate various economic scenarios to evaluate the impact on loan portfolios. This enables institutions to prepare for adverse conditions and mitigate potential risks effectively.

Custom Credit Risk Management Software

Custom software solutions offer features such as automated data collection and analysis, predictive analytics for risk forecasting, and seamless integration with existing banking systems. Cloud-based platforms enhance scalability and cost-effectiveness, while mobile solutions provide real-time access to critical risk metrics.

Mobile Solutions for Real-Time Insights

Mobile apps provide stakeholders with on-the-go access to critical risk metrics, aligning with mobile banking trends. Mobile solutions are transforming credit risk management in banks by offering real-time insights that empower stakeholders to make timely, informed decisions. By leveraging mobile apps, financial institutions can enable executives, risk managers, and even customers to access critical data and analytics from anywhere, ensuring that they stay connected to essential metrics and risk factors, regardless of location.

-

Instant Access to Key Metrics: Mobile applications give real-time access to key credit risk metrics such as credit scores, outstanding balances, transaction histories, and more. This on-the-go capability is especially valuable for risk managers who need to constantly monitor and evaluate risk, even when they are not at their desks.

-

Enhanced Decision-Making: With mobile apps, stakeholders can quickly review risk profiles, flag high-risk borrowers, and take necessary actions in real-time. For instance, mobile alerts can notify risk managers when there is a sudden change in a borrower’s financial behavior, enabling quick intervention before the risk escalates.

-

Integration with Core Banking Systems: Many mobile solutions integrate directly with core banking systems, ensuring that the latest data is always at the fingertips of decision-makers. This seamless integration ensures that stakeholders have a comprehensive view of the customer’s creditworthiness, financial health, and potential risk factors at all times.

-

Empowering Field Teams: Sales and customer service teams, who are often in the field, can also benefit from mobile risk management solutions. They can access client profiles, assess loan eligibility, and perform risk assessments in real-time, improving customer service and reducing delays in decision-making.

-

Mobile-First Risk Analytics: Mobile apps designed with advanced data analytics features help institutions analyze vast amounts of financial data on the go. This allows risk teams to spot emerging trends, anomalies, and patterns that might indicate a shift in credit risk, making predictive risk management more efficient and accurate.

-

Customer Interaction: For customers, mobile solutions can offer greater transparency into their credit status and real-time alerts regarding their loan conditions or any risk-associated changes. This helps in managing their credit risk by fostering more responsible borrowing behaviors.

As mobile banking becomes more prevalent, credit risk management in banks must keep pace with consumer expectations for seamless, mobile-first experiences. Mobile solutions align with this trend by ensuring that stakeholders, whether they are in the office or in the field, can access the same rich set of data and insights traditionally reserved for desktop environments. This shift is particularly crucial in managing fast-moving risks in a dynamic financial environment. Additionally, mobile solutions often provide intuitive user interfaces, making complex risk data more accessible to a wider range of users and improving overall decision-making.

Savvycom: Your Trusted Partner in Banking Solutions

At Savvycom, we specialize in building banking solutions that not only provide excellent customer experiences but also mitigate financial risks. As a leading mobile banking app development company, we provide comprehensive digital banking solutions that streamline banking operations, improving efficiency in credit risk management in banks. By automating processes and integrating data analytics, financial institutions can assess credit risk more accurately and react quickly to potential issues, enhancing their ability to manage risk in real time.

What We Offer:

-

Banking App Development: Our customized banking apps provide essential features for credit risk management in banks, such as real-time credit score tracking and risk alerts. These apps give risk managers access to vital customer data, allowing them to detect high-risk borrowers and intervene promptly, minimizing financial exposure.

-

e-Wallet Development Solution: Savvycom’s e-wallet solutions enhance security and reduce fraud risks, a crucial aspect of credit risk management in banks. With secure payment systems and real-time transaction monitoring, institutions can identify suspicious behavior quickly, mitigating the impact of potential financial fraud and improving overall risk mitigation.

-

Mobile Banking Solutions: Our mobile banking solutions offer stakeholders real-time access to risk metrics, enabling timely interventions in credit risk management in banks. By delivering features like loan tracking and risk notifications, mobile banking apps help institutions monitor and manage credit risk more effectively, ensuring swift action when needed. Additionally, we also update mobile banking trends like integrating AI-powered analytics and biometric authentication into its mobile banking solutions to enhancing credit risk management in banks capabilities in an evolving digital landscape.

With expertise in technology in banking, we ensure scalable, secure, and compliant solutions tailored to the unique challenges of the financial industry. Partner with us to build reliable systems that set you apart in a competitive market.

Tech Consulting, End-to-End Product Development, Cloud & DevOps Service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]