The Role of Photos And Biometrics in Banking Security

Banks of all sizes live and breathe digital security, so much so that they can usually be found right at the forefront of cybersecurity innovations. Their desire to protect data is not just about making strong KYC procedures or AML initiatives. On the contrary, they always need to walk the extra mile in order to protect customers by accurately identifying each one. That’s exactly the purpose of using biometrics in banking as well as advanced photography in this entire industry. These mechanisms are extremely potent when it comes to protecting financial institutions and the overall ecosystem surrounding these companies. In this post, we’ll explain what makes biometrics in banking so powerful in the first place.

Biometrics In Banking

What’s Wrong with Traditional Banking Security Methods?

The short answer is easy – there is nothing essentially wrong with traditional forms of banking security. However, these data protection models have become insufficient for modern financial operators because they are unable to cope with technologically superior cyber threats. Here’s what we’re talking about:

- It’s easy to forget a password, while hackers can easily discover it if reused across multiple accounts.

- Two-factor authentication is strong, but malicious actors can also intercept SMS codes to steal users’ login credentials.

The point is that traditional cybersecurity methods rely heavily on knowledge-based authentication. Though solid, this type of authentication is easy to bypass if a hacker possesses enough information about a client. This is why biometrics in banking is so important today—it successfully eliminates the threats commonly associated with traditional safety tools.

The same goes for photography-based systems since these allow clients to take professional photos in order to prove their identities. In this case, the point is to confirm your identity remotely by uploading a selfie. Bear in mind, however, that this has to be a quality image. Most banks demand excellent images for verification purposes, so it’s worth reading this how-to guide on how to make iPhone photos look professional. Clients who follow these iPhone photography instructions are guaranteed to capture images like a pro.

A 2023 survey by the Federal Reserve found that 53% of fraud attacks in the banking sector were linked to compromised login credentials, which shows how vulnerable traditional systems still are. This is why biometrics in banking is so important today—it successfully eliminates the threats commonly associated with traditional safety tools.

A Quick Introduction to Biometrics in Banking (Plus Main Types)

You can find hundreds of definitions of biometrics in banking, but the bottom line is this: It’s a relatively new technology in banking that analyzes a client’s unique physical characteristics to confirm their identity.

In a nutshell, these physical traits are nearly impossible for malicious actors to forge—especially on a daily basis. It is also necessary to mention that physical traits come in different forms, and so do the methods of biometrics in banking user authentication:

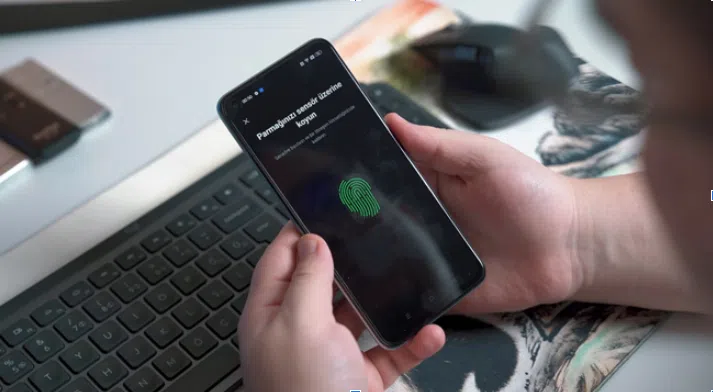

- Fingerprints: You’ve seen this one many times before since it’s the oldest type of biometrics in banking. Each person possesses unique fingerprints, and scanning them is widely used in mobile banking apps development and ATMs.

- Facial recognition: This technology isn’t as common as fingerprint scanning, but it’s gradually getting there since facial recognition is now a common solution for conducting remote onboarding processes. In fact, a study by Juniper Research estimates that 1.4 billion people will use facial recognition for banking by 2025.

- Voice recognition: Some banks prefer voice recognition because it allows them to secure phone-based services while authorizing transactions.

- Iris/retina scans: This is probably the most advanced biometrics in banking method, which also makes it the rarest. It’s possible for financial institutions to scan a given client’s eye to identify a person.

Using only one of these verification models makes the banking system close to impenetrable. It makes the entire banking security model much stronger whilst improving the overall client experience. Bear in mind that 80% of security threats still involve compromised login credentials – this is why biometrics is so appreciated these days.

A Specific Role of Photos in Banking Security

Together with biometrics in banking verification, photos play a significant role in cybersecurity. This is especially relevant for customer onboarding because high-quality images allow for a simpler authentication system that almost anyone can take advantage of—the only precondition is having a smartphone with a solid camera.

At its core, the idea is pretty simple: A bank’s client can upload photos of themselves along with official identification documents. This is done remotely, so you don’t need to visit the actual bank to verify your identity—the system does it automatically without requiring in-person visits.

| Fraud Type | Description | How the System Detects It |

|---|---|---|

| Forged Documents | Completely fake identification documents | Analyzes fonts, watermarks, holograms, and document structure |

| Altered Images | Original photos that have been edited or manipulated | Detects pixel manipulation traces and metadata anomalies |

| Spoofing Attacks | Using printed photos or videos to trick the system | Liveness detection and 3D depth analysis |

| Identity Theft | Using another person’s legitimate documents | Cross-matching facial features with document photos |

| Synthetic Identity Fraud | Combining real and fake information to create a new identity | AI pattern recognition and database cross-referencing |

Another great thing about this system is that it helps detect malicious attempts of all sorts. For instance, photo checks paired with face authentication for banks will quickly discover forged documents and altered images in real time. That’s because such systems rely on AI-driven software trained on biometric certification dataset standards that can analyze even the most negligible details on a given image. While consumer applications like photo book software focus on enhancing image quality for personal use, banking systems prioritize security analysis and fraud detection capabilities.

Final Thoughts: It’s the Next Gen Security Solution

Movies like “Total Recall” and “Blade Runner” made most of us believe that biometrics in banking is a faraway tech trend, but the truth is that we already have it in the banking sector. It’s the present of modern cybersecurity, and we don’t see anything better replacing these tools in the foreseeable future because they make financial transactions as close to flawless as they get.

From Tech Consulting, Mobile App Development Services, Web App Development Services to #1 Vietnam outsourcing software service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. Savvycom dedicated software development team can help you to build high-quality custom software development services and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]