Top 5 Effective Applications of Closed-Loop Payment Systems

In an era where digital transactions dominate, closed-loop payment systems have emerged as a pivotal tool for businesses seeking to streamline financial operations and enhance customer experiences. Unlike open-loop systems that operate across multiple merchants and networks, closed-loop systems are restricted to specific retailers or a network of related entities. This restriction offers unique advantages, including enhanced control over transaction processes, better data insights, and improved customer loyalty. As a leading software development company, Savvycom specializes in designing and implementing these systems, providing tailored solutions to various industries. This article delves into the top five effective applications of closed-loop payment systems, offering an in-depth analysis of their benefits, challenges, and potential.

1. Retail Loyalty Programs

Retail loyalty programs have become one of the most prominent applications of closed-loop payment systems, transforming the way businesses engage with their customers. By offering branded payment cards or digital wallets, retailers can incentivize customer loyalty through a variety of rewards, including discounts, points accumulation, and exclusive offers. These systems not only encourage repeat purchases but also provide retailers with invaluable data on customer behavior, preferences, and spending patterns.

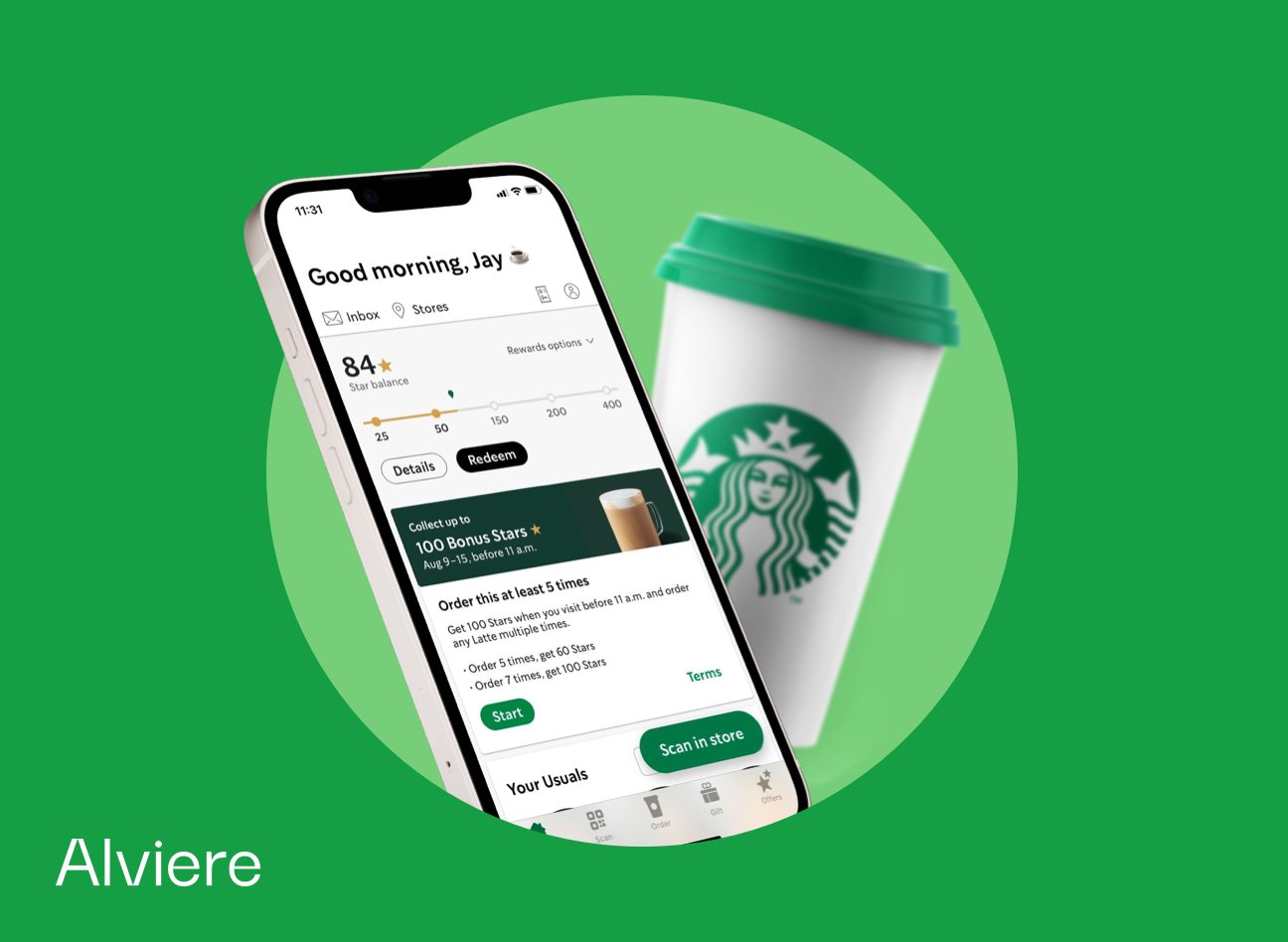

One notable example is Starbucks, which has successfully implemented a closed-loop payment system through its mobile app. The app, which boasts over 16 million active users in the U.S., integrates payment and rewards seamlessly. Customers can easily reload funds, earn stars, and redeem rewards, creating a convenient and engaging user experience. In 2021, Starbucks reported that 44% of its U.S. sales were processed through the app, highlighting the system’s significant impact on customer engagement and revenue generation.

Image source: Alviere

From a technical perspective, developing such systems requires a robust software infrastructure capable of handling high transaction volumes and ensuring data security. By leveraging advanced data analytics, these systems can personalize offers, optimize inventory management, and refine marketing strategies, thereby enhancing overall customer satisfaction and driving growth. For instance, data collected through these systems can identify purchasing trends, enabling retailers to tailor their product offerings and promotional campaigns more effectively.

Moreover, closed-loop payment systems in retail can significantly reduce transaction fees, as they eliminate the need for third-party payment processors. This cost efficiency, combined with the enhanced customer experience, makes closed-loop systems an attractive option for retailers looking to boost profitability. Additionally, the ability to collect detailed transaction data allows for more accurate demand forecasting and inventory management, reducing the risk of stockouts or overstock situations.

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

2. Campus Payment Solutions

Closed-loop payment systems have found widespread application in educational institutions, particularly universities and colleges. These institutions often issue campus cards that serve as multi-functional tools for students, faculty, and staff. These cards facilitate a variety of transactions, including dining services, library access, bookstore purchases, and even entry to campus events. The efficiency and convenience of these systems make them invaluable for managing both financial and administrative tasks within the campus ecosystem.

A closed-loop payment system for students across the campuses allows students to make cashless transactions at dining halls, bookstores, and other campus services, simplifying financial management and enhancing security. The integration of various campus services into a single card system not only streamlines transactions but also offers a unified platform for managing student accounts and financial aid disbursements.

The implementation of campus payment systems involves integrating multiple services into a cohesive platform, ensuring compatibility and security across different functions. These systems offer features such as online account management, mobile app integration, and automated billing, providing a seamless experience for users. Parents can also easily add funds to their children’s accounts, while students can track their spending and manage their budgets effectively.

Furthermore, closed-loop systems in educational settings can enhance campus security by integrating access control features. These systems can restrict access to specific areas, such as dormitories or laboratories, based on user profiles, thereby enhancing safety and security. Additionally, the data collected through these systems can help administrators monitor campus activities, identify trends, and make data-driven decisions to improve campus operations.

3. Transportation and Transit

The transportation sector has been a significant beneficiary of closed-loop payment systems, particularly in public transit networks. These systems simplify fare collection, reduce operational costs, and enhance the convenience for commuters. A prime example is the Octopus card in Hong Kong, a widely adopted closed-loop payment system used across various modes of transport, including buses, trains, and ferries. The card’s versatility extends to retail purchases, making it an indispensable tool for daily life in Hong Kong. According to the Hong Kong Monetary Authority, the Octopus card processes over 15 million transactions daily, accounting for 99% of Hong Kong’s adult population.

Image source: South China Morning Post

The success of such systems hinges on a robust technological infrastructure that is secure, scalable, and capable of handling a large number of transactions simultaneously. Savvycom specializes in developing sophisticated transit payment solutions that integrate with existing transport systems. These solutions offer features like contactless payments, real-time balance updates, and fraud detection, enhancing the overall efficiency and security of public transport networks. For example, the integration of contactless payments not only speeds up boarding times but also reduces the need for physical cash handling, thus minimizing the risk of theft and fraud.

Moreover, closed-loop payment systems in transportation can provide valuable data analytics that help city planners and transport authorities optimize route planning and resource allocation. By analyzing transaction data, authorities can identify peak travel times, popular routes, and areas with high demand, enabling them to adjust service schedules and improve overall service efficiency. This data-driven approach can also aid in future urban planning initiatives, such as the development of new transit routes or the expansion of existing ones.

As urbanization and smart city initiatives continue to grow, the adoption of closed-loop payment systems in transportation is expected to increase, offering new opportunities for innovation and improvement. These systems can also support multimodal transport solutions, allowing passengers to use a single payment method across different modes of transport, such as buses, trains, and bike-sharing services. This seamless integration enhances the overall user experience and encourages the use of public transport, contributing to more sustainable urban mobility.

Looking For a Trusted Tech Partner?

We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

4. Corporate Expense Management

Corporate expense management is another area where closed-loop payment systems have proven to be highly effective. Companies often issue corporate cards or digital wallets to employees for business-related expenses, such as travel, meals, and office supplies. These systems offer greater control over spending, as they can restrict purchases to specific categories or vendors. Additionally, they simplify the expense reporting process by automatically tracking and categorizing transactions.

Implementing these systems requires a deep understanding of a company’s financial policies and operational needs. By offering real-time insights into employee spending, these systems help companies optimize their expense management processes, improve financial accountability, and reduce administrative overhead. For instance, companies can set spending limits based on employee roles or project budgets, preventing overspending and ensuring adherence to financial policies.

Additionally, closed-loop systems can integrate with enterprise resource planning (ERP) systems, providing a seamless flow of financial data across the organization. This integration enables companies to generate comprehensive financial reports, monitor budget performance, and make informed business decisions. Furthermore, the data collected through these systems can be used to negotiate better terms with vendors, as companies gain insights into their spending patterns and vendor relationships.

5. Gift Card Programs

Gift card programs are a popular application of closed-loop payment systems, particularly in the retail and hospitality industries. These cards are restricted to a specific brand or group of brands, allowing businesses to retain funds within their ecosystem. Gift cards serve as both a convenient gifting option and a marketing tool that drives brand loyalty and customer acquisition. The implementation of gift card programs requires a sophisticated software solution capable of managing card issuance, balance tracking, and redemption. By providing a seamless user experience, these systems enhance customer satisfaction and encourage repeat business, making them a valuable addition to any brand’s marketing strategy.

Gift card programs also offer significant financial benefits for businesses. For one, they provide an immediate cash inflow upon purchase, even if the cards are not redeemed right away. Additionally, a portion of gift cards typically goes unused, known as “breakage,” which can contribute to the company’s revenue. Furthermore, when gift cards are used, they often result in additional spending beyond the card’s value, further boosting sales.

Image source: Wellyx

From a marketing perspective, gift cards can be used to promote new products, encourage visits during off-peak seasons, and attract new customers. Businesses can also use gift card data to analyze customer preferences and purchasing behaviors, enabling them to tailor marketing campaigns and product offerings more effectively. For instance, a retail chain could track which gift cards are most frequently redeemed and for which products, allowing them to optimize inventory and promotional strategies.

Get in touch with Savvycom for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

Frequently Asked Questions

How do closed-loop payment systems benefit retailers?

Closed-loop payment systems benefit retailers by encouraging repeat business, providing valuable customer data, and reducing transaction fees. These systems also offer opportunities for targeted marketing and personalized promotions, enhancing the overall customer experience.

Can closed-loop payment systems be integrated with mobile apps?

Yes, closed-loop payment systems can be integrated with mobile apps, offering users a convenient and secure way to manage their funds, make purchases, and track rewards. Integration with mobile apps also enables features like contactless payments and real-time balance updates.

Are closed-loop payment systems secure?

Closed-loop payment systems are generally secure, as they can incorporate advanced security features like encryption, secure authentication, and fraud detection. However, the security of these systems depends on the quality of the underlying technology and the implementation of best practices by the service provider.

How can businesses implement a closed-loop payment system?

Businesses can implement a closed-loop payment system by partnering with a software development company that specializes in payment solutions, such as Savvycom. The process typically involves developing a customized platform, integrating with existing systems, and ensuring compliance with relevant regulations.

Conclusion

Closed-loop payment systems offer numerous benefits across various sectors, from retail and education to transportation and corporate finance. These systems provide enhanced control, improved data insights, and a seamless user experience, making them an essential tool in today’s digital economy. However, implementing and managing closed-loop systems requires specialized knowledge and expertise, particularly in areas such as cybersecurity and compliance. As a leading software development company, Savvycom offers comprehensive solutions for developing and managing closed-loop payment systems. With expertise in secure software development, payment gateway integration, and mobile app development, Savvycom provides tailored banking and financial solutions that meet the unique needs of businesses across various industries. Whether it’s designing a robust infrastructure for retail loyalty programs, developing campus payment solutions, or creating secure corporate expense management systems, Savvycom delivers innovative and reliable platforms.

By partnering with Savvycom, businesses can leverage cutting-edge technology and industry best practices to stay competitive in the rapidly evolving payment landscape. Savvycom’s holistic approach ensures that all aspects of a company’s payment system—from design and development to security and compliance—are handled with the utmost care and expertise.