All You Need To Know About E-Wallet App Development: 2025 Comprehensive Review!

Developing an e-wallet application can indeed be challenging, given the complexities involved, compliance laws to adhere to, and the competitive landscape. However, this article on “All you need to know about e-wallet app development” will simplify the process, making it easy to understand. Whether you’re a startup founder, serial entrepreneur, tech executive, or simply someone interested in learning about e-wallet app development, you’ll find this guide invaluable. Let’s dive in!

What Is An E Wallet And How Does It Work?

What is E-Wallet and how does it work?

An e-wallet, or digital wallet, is a handy tool that simplifies financial transactions in our increasingly digital world. Picture having all your payment methods—credit cards, coupons, boarding passes, and more—securely stored in one virtual space. Here’s how e-wallet app development makes life easier:

- Digital Storage: E-wallets let you store sensitive information, like card numbers and personal data, in a secure, encrypted form. This adds a layer of security, making it tough for fraudsters to steal money or identities.

- Smooth Transactions: No more rummaging through your physical wallet when making a purchase. With e-wallets, you can make payments with a simple click. Say goodbye to typing billing addresses, account numbers, or credit card details.

- Versatility: E-wallets come in different types. Apple Pay is great for in-store purchases, while Venmo and Cash App are perfect for quick peer-to-peer payments. Each acts as a digital hub for your financial essentials.

Popular E-Wallets:

- Cash App: It’s a versatile digital wallet for storing cards, sending money, and even dealing in cryptocurrency.

- Apple Pay: Widely accepted in physical stores, allowing you to pay with a tap of your phone.

- Venmo: Ideal for splitting bills among friends and family.

- PayPal: A trailblazer in e-wallets, setting the stage for this digital shift.

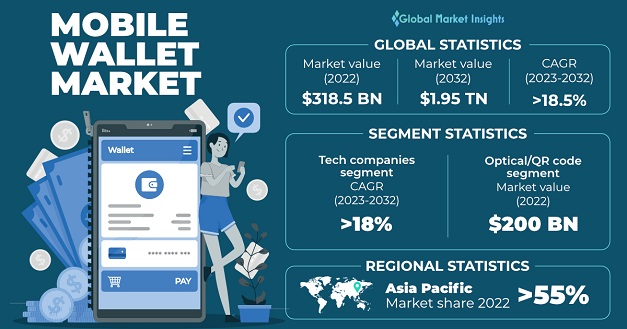

Overview Of The E-wallet Market

Global Statistics on the E-Wallet Development Industry

According to Statista, as of 2023, the number of mobile wallet users worldwide is expected to reach 1.31 billion, reflecting a substantial increase from previous years. This trend highlights the growing market for digital payment solutions.

Additionally, according to a report by ResearchAndMarkets, the global digital payment market size is projected to grow from USD 79.30 billion in 2020 to USD 154.06 billion by 2025, at a CAGR of 15.2% during the forecast period.

- The digital market industry is projected to grow at a rate of 27.4% from 2022 to 2030.

- By 2027, the volume of the digital payment market is estimated to reach $15.17 trillion.

- Currently, 82% of US consumers utilize mobile digital payment services (Pew Research).

- In the United States, there are over 273.76 million smartphones capable of using e-wallet mobile apps (Statista).

What Are The Three Most Important Characteristics Of An E-Wallet?

Below are the 3 most important features of e-wallets that have made it so popular. Security is the bedrock of every e-wallet, ensuring users’ financial information remains protected. Here’s how e-wallet app development achieves this:

- Encryption: E-wallets use encryption to scramble sensitive data, making it unreadable to unauthorized parties during transmission.

- Two-Factor Authentication (2FA): Adding an extra layer of security, 2FA ensures only authorized users can access their e-wallets, requiring a second form of verification beyond passwords.

- Secure Coding Practices: Developers adhere to best practices to thwart vulnerabilities and shield against cyber threats, ensuring the integrity of the e-wallet system.

On the user front, a friendly interface is crucial for e-wallet adoption:

- Simplify Navigation: Intuitive menus and clear labels make navigating e-wallets effortless, eliminating the need for user manuals.

- Streamline Transactions: From bill payments to fund transfers, e-wallets should offer a straightforward process, catering to users of all technical levels.

Lastly, an e-wallet’s effectiveness relies on its acceptance:

- Merchant Compatibility: Seamless integration with both online and physical stores enhances everyday usability.

- Cross-System Compatibility: E-wallets should function seamlessly across various platforms, including Android, iOS, and web browsers.

- Currency Agnosticism: Supporting multiple currencies facilitates global transactions, empowering users worldwide to manage their finances effortlessly.

How Can E-wallet Transform The Future Of Online Transactions?

E-Wallet’s Impact on the Future of Online Trading

E-Wallet App Development Impact on the Future of Online Trading

So, how might e-wallets reshape the landscape of online transactions in the future? Let’s break it down:

- Going Cashless: Digital wallets make paying for things easy without needing physical cash. Whether it’s groceries, flight tickets, or bills, a few taps on your phone gets it done. This shift away from cash makes transactions quicker and safer since you don’t have to carry physical money around.

- Financial Inclusion: These payment platforms help reach people who don’t have access to traditional banking services. Even in remote areas where there are no banks, mobile wallets let people join the digital economy using their phones. This means more people can access financial services, which can boost economic growth.

- Simplifying Global Trade: Digital wallet systems make it easy to buy and sell across borders. Travelers don’t need to exchange currencies anymore because their mobile payment apps handle it for them. This is great for businesses operating internationally, as these platforms help overcome currency differences.

- Cryptocurrency Involvement: These platforms now support cryptocurrencies like Bitcoin and Ethereum. Users can keep, trade, and spend digital currencies in their wallets. This opens up opportunities for decentralized finance (DeFi) and investment.

- Budgeting and Tracking Expenses: Mobile wallet apps do more than just process payments; they help manage finances. Users can set budgets, keep track of spending, and get real-time insights. According to a survey by the American Bankers Association, 39% of consumers state that they use digital wallets for expense tracking and budgeting.

In essence, e-wallet app development presents a transformative remedy to the challenges posed by traditional payment methods, paving the way for a future where online transactions are swifter, more inclusive, and interconnected on a global scale.

E-wallet App Development Cost

The move towards cashless transactions, increased financial inclusion, and the potential for e-wallets to simplify global commerce underscore the rising importance of digital payment solutions. When it comes to assessing the app development cost of an e-wallet app, several factors play a crucial role. These factors include the features integrated into the app, the platforms it caters to, the security measures it employs, and the location of the development team.

For instance, a basic e-wallet app development service might come with a price tag ranging from $15,000 to $50,000, taking anywhere from a few weeks to several months to develop. However, more intricate apps with advanced functionalities and strict security standards may entail higher costs and longer development periods.

What To Consider For A Secure Digital Wallet App Development?

Considerations for Developing an E-Wallet Application

Considerations for Developing an E-Wallet Application When it comes to crafting a secure digital wallet app, it’s all about putting users’ peace of mind first. Here’s a rundown of what you should focus on:

- Understanding Users Inside Out: Dive deep into what users need and what the market is asking for. This sets the stage for a solid and secure app that meets everyone’s expectations.

- Locking Things Down with Strong Authentication: Beef up security by adding features like fingerprints, one-time passwords, and double-check logins. These extras make it much harder for anyone to sneak into your app.

- Keeping Secrets Secret with Secure Data Transmission: Make sure all the info traveling between your app and its servers is under lock and key. Encrypting it with the latest tech means no one can peek at what’s being sent or change it on the way.

- Making Sure Users are Who They Say They Are: Set up hoops for users to jump through when they sign up or make transactions. This keeps the bad guys from slipping through the cracks and messing with your app.

- Playing by the Rules with Compliance Standards: Stick to the rules laid out by industry bigwigs like PCI DSS. Doing so not only beefs up your app’s security but also earns you some serious trust points with users.

- Keeping Data Safe and Sound: Store all that sensitive user data in a fortress of encryption, and make sure you’re following all the local privacy rules. This way, users can rest easy knowing their info is in good hands.

- Staying One Step Ahead with Regular Security Checks: Keep poking and prodding your app for weak spots. Finding and fixing them pronto means you’re always ready for whatever sneaky stuff the bad guys throw your way.

- Making Friends with Security Updates: Keep your app fresh with regular updates and patches. It’s like giving your app a shiny new shield to fend off the latest threats.

- Teaching Users to Be Their Own Heroes: Show users the ropes on how to keep their own info safe. A little know-how goes a long way in keeping everyone’s e-wallets snug as a bug in a rug.

By keeping these points in mind, you can craft a digital wallet app that not only keeps users’ data safe but also makes them feel confident in using it.

Partner with us at Savvycom, a prominent IT outsourcing provider, and let’s transform your concept into a sought-after, scalable app that resonates with your audience.

Our team of seasoned developers at Savvycom has extensive experience and the necessary expertise to handle mobile application development projects of all complexity levels. With our support, you can expect your app to come to life within a matter of months. Let’s collaborate and bring your vision to fruition with our e-wallet app development services today!

How To Create An E Wallet App: Comprehensive Guide!

Here’s what you need to consider before diving into e-wallet app development, followed by the steps to actually build one.

Set objectives and understand your audience

Start by defining what you want your e-wallet app to achieve. Figure out what specific problems your app will solve for users. Are you looking to streamline online shopping, enable easy money transfers between peers, or offer comprehensive financial management tools? It’s crucial to know who your target users are – their demographics, preferences, and habits – so you can tailor your app to meet their needs effectively.

Research the market and analyze competitors

Dive deep into the market to understand what’s out there. Study existing e-wallet solutions to identify any gaps and see what features are popular with users. By analyzing your competitors, you can find ways to make your e-wallet app development stand out and avoid being just another copycat in a crowded market.

Create a feature list

Based on your research findings, make a detailed list of features for your app. Think about what users absolutely need, like account management and transaction tracking, as well as any unique features that could set your app apart, such as loyalty programs or investment options. Prioritize these features based on user needs and what’s feasible to develop, creating a roadmap for your app’s development.

Design the user experience

The design phase is where your app comes to life visually. A user-friendly interface and smooth experience are crucial for keeping users engaged. Your app should be easy to use, visually appealing, and accessible. Focus on making transactions as quick and simple as possible, translating complex financial processes into an intuitive user journey.

Choose the right technology

Picking the right technology stack is essential for your app’s performance and scalability. Consider factors like which platform to develop for (iOS, Android, or both), programming languages, and frameworks. Your chosen tech should support your app’s features, be secure, and allow for future updates. Ensure that you incorporate payment gateway integration so your users have multiple options for transactions. Collaborating with e-wallet app development companies can also provide the expertise needed for this phase.

Develop the backend and APIs

The backend is where all the data processing happens, so it needs to be robust and secure. Design it to handle user accounts, transactions, and data safely. APIs connect your app to other services, like banks and payment networks, enabling various financial transactions within your app.

Ensure security

Security is paramount in financial apps. Implement strong security measures like encryption and multi-factor authentication to protect users’ sensitive data. Regular security audits and compliance with legal standards are also crucial to maintain trust.

Integrate payment gateways

Seamless payments are essential for any e-wallet app development. Integrate reliable payment gateways that allow users to link their bank accounts, credit cards, and other payment methods securely. Ensure the payment process is smooth and supports multiple currencies if needed.

Test thoroughly

Before launching, rigorously test your app to catch any bugs and ensure everything works as intended. This includes user testing, performance testing, and security testing. Quality assurance is an ongoing process to ensure a positive user experience.

Launch, monitor, and improve

Launching your app is just the beginning. Keep an eye on its performance post-launch, gather user feedback, and address any issues promptly. Your e-wallet app development should evolve with your user base, adapt to new technologies, and continuously improve to stay relevant.

Recap: All You Need To Know About Ewallet App Development

E-wallet app development isn’t just a passing fad – it represents the future of financial transactions. With their power to simplify payments, boost security, and provide unmatched convenience, e-wallets are poised to be a vital component of the financial world. When creating an e-wallet app, it’s essential to prioritize security, user experience, and keeping up with mobile app development trends to thrive in this competitive landscape. Collaborating with dedicated professionals, like a competent mobile app development team, can significantly enhance your project’s likelihood of success. We trust our article, “All You Need to Know About E-Wallet App Development,” has been informative. Thank you.

Explore the Power of Ewallet App Development with Savvycom!

Well-known as a top-tier software development company, Savvycom has been leading the charge since 2009. Our expertise in Payment Technologies has driven business growth across diverse industries. Let us assist you in crafting top-notch software solutions and products, along with a comprehensive suite of professional services tailored to your needs. Partner with Savvycom and unlock the full potential of your healthcare endeavors today!

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: [email protected]