Exploring the Largest Payment Processing Companies in 2025

In the fast-paced digital economy of 2025, payment processing companies have become critical enablers of global commerce. As consumers increasingly demand seamless, secure, and instant payment options, businesses, both large and small, rely on these companies to facilitate financial transactions. The largest payment processing companies play a crucial role in ensuring that transactions between customers and merchants are smooth, fast, and safe. This article provides a detailed analysis of the largest payment processing companies in 2025, looking into their market share, business models, services, technologies, and their overall impact on the payments landscape. As these companies continue to innovate, many are collaborating with software development companies to integrate new technologies and enhance the payment experience.

Understanding Payment Processing Companies

Payment processors are intermediaries between buyers and sellers, helping facilitate transactions by ensuring that payments made by consumers are properly authorized and funds are transferred to the merchants. These companies act as a bridge, handling the complexities of payment systems, security, and compliance with regulatory standards. They offer solutions such as credit card and debit card processing, mobile payment solutions, fraud detection, and even cross-border payments, all while ensuring the safety and privacy of the transaction parties.

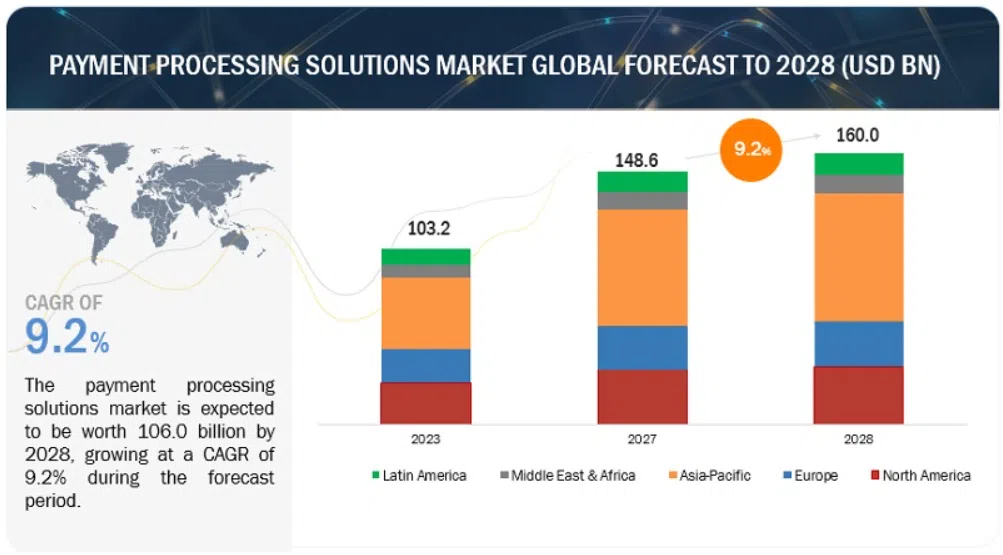

According to a report by Marketsandmarkets, the global payment processing market is projected to grow from $103.2 billion in 2023 to $160 billion by 2028, highlighting the increasing importance of these solutions. Additionally, many of the largest payment processing companies partner with software development companies to build more efficient and secure systems that meet the demands of a rapidly evolving digital landscape.

Image source: Marketsandmarkets

The Market Landscape of Payment Processing

The payment processing industry is massive, with global digital payment volumes expected to reach over $9 trillion by 2025. The industry is dominated by a few large players who have built robust infrastructures to handle massive volumes of transactions on a daily basis. These companies don’t just process payments—they also innovate, providing digital payment platforms ranging from mobile digital wallets to cryptocurrency transactions, all while ensuring compliance with international security standards like PCI-DSS (Payment Card Industry Data Security Standard). The largest payment processing companies continue to expand their footprint, adding new capabilities to their portfolios to meet growing demand.

Let’s explore the largest payment processing companies in 2025, examining their histories, services, and the factors that have propelled them to the top of the industry.

1. Visa: The Global Payments Powerhouse

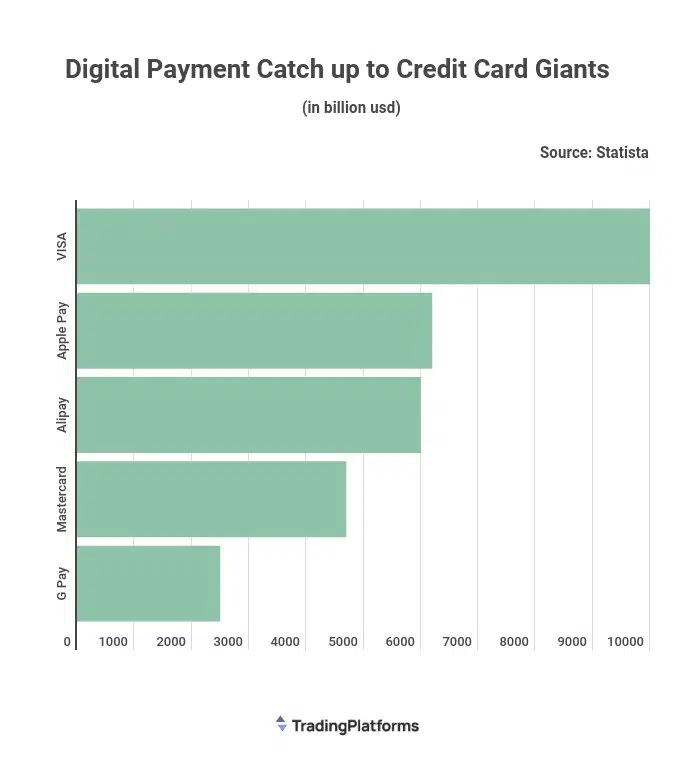

Market Share: Visa is one of the most recognized names in global payments, and in 2025, it continues to dominate the payment processing industry. The company operates in over 200 countries, connecting millions of merchants with billions of consumers worldwide. Visa’s card network processes transactions worth more than $11 trillion annually, making it a formidable player in the global payment solutions ecosystem. As one of the largest payment processing companies, Visa has built a comprehensive infrastructure to support its vast network of financial institutions and merchants.

Key Services:

- Credit and Debit Card Transactions: Visa’s extensive cardholder base provides easy access to both personal and business credit services worldwide.

- Contactless Payments: Visa has led the charge in promoting secure, contactless payment methods, allowing consumers to make payments simply by tapping their cards or smartphones.

- Fraud Prevention: Visa offers advanced fraud protection solutions, including real-time alerts and risk management tools, to protect both consumers and merchants from unauthorized transactions.

- Mobile Wallet Integration: Visa has integrated its payment solutions with mobile payment systems like Apple Pay, Google Pay, and Samsung Pay, making it easier for consumers to make payments using their smartphones.

- Visa Direct: This service allows businesses to send money quickly and efficiently through a push payment system, helping merchants process payments faster and with greater security.

- Technological Innovation: Visa’s technological leadership extends to its work in tokenization, blockchain technology, and its commitment to adopting artificial intelligence (AI) and machine learning for fraud detection. These technologies enhance security and the overall user experience, allowing Visa to handle billions of transactions securely and efficiently.

Visa’s long-standing partnerships with banks, financial institutions, and merchants worldwide have cemented its position as a leader among the largest payment processing companies.

2. Mastercard: Innovation at the Forefront

Market Share: Mastercard, another major player in the payment processing sector, serves millions of merchants across the globe and processes nearly $6 trillion in payments annually. Like Visa, Mastercard is a global brand, and its services are used by millions of consumers and businesses every day. Mastercard continues to be one of the largest payment processing companies, with a strong emphasis on technological advancements and security.

Image source: forums apple insider

Key Services:

- Digital/B2B Payment Solutions: Mastercard offers a broad range of payment systems, including contactless cards, mobile wallets, and virtual payment cards.

- Cross-Border Payment Solutions: Mastercard is heavily involved in international payments, providing services that enable businesses to accept and send payments across borders easily.

- Tokenization and Fraud Prevention: Similar to Visa, Mastercard has invested heavily in developing fraud protection systems, utilizing tokenization and AI-driven risk management techniques to ensure safe transactions.

- Cryptocurrency Integration: Mastercard has become a pioneer in integrating cryptocurrency into its payment platforms. By offering services that support digital currencies, Mastercard is positioning itself as a forward-thinking payment processor ready to embrace the future of payments.

- Technological Innovation: Mastercard has embraced the potential of blockchain and artificial intelligence, both of which are crucial in combating fraud, improving user experience, and enabling faster cross-border payments. The company’s efforts to integrate digital currency solutions into its platform further demonstrate its commitment to staying ahead of the curve.

Mastercard’s strong partnerships with banks and financial institutions, combined with its innovative approach to payment processing solutions, have enabled it to compete effectively in the global payments market. As one of the largest payment processing companies, it remains a key player in shaping the future of payments.

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

3. PayPal: The E-Commerce Revolution

Market Share: As one of the earliest pioneers of online payments, PayPal has grown to become one of the largest digital payment platforms, processing hundreds of billions of dollars annually. Founded in 1998, PayPal now operates in more than 200 countries and offers services to millions of consumers and businesses worldwide. PayPal’s focus on e-commerce has helped it maintain a dominant position among the largest payment processing companies, particularly in the online retail space.

Key Services:

- Online Payments and Money Transfers: PayPal is the go-to payment processor for millions of e-commerce transactions, enabling both individuals and businesses to send and receive money online quickly and securely.

- Peer-to-Peer Payments (Venmo): PayPal owns Venmo, a widely popular mobile payment solution in the U.S. that allows users to send and receive money instantly using their smartphones.

- Cryptocurrency Integration: In a move to diversify its services, PayPal has integrated cryptocurrency trading into its platform, allowing users to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Merchant Services: PayPal provides payment gateway solutions for businesses, enabling them to accept payments online, process recurring payments, and offer subscription services.

- Technological Innovation: PayPal has become synonymous with e-commerce payments. Its commitment to innovation is evident in its adoption of mobile payments, AI, and blockchain technology. PayPal’s acquisition of Honey, a shopping assistant and rewards platform, shows its dedication to enhancing the customer experience.

With its continued focus on technology and the customer experience, PayPal remains a dominant force in the digital payments industry, especially within e-commerce.

4. Stripe: A Developer-Centric Payment Processor

Market Share: Stripe has quickly ascended the ranks of payment processors, particularly in the tech industry. Founded in 2010, Stripe now serves over 100,000 businesses globally, including large companies like Amazon, Google, and Shopify. Stripe processes billions of dollars in payments annually, establishing itself as one of the largest payment processing companies, particularly favored by startups and SaaS businesses.

Key Services:

- Online Payment Gateway: Stripe offers a seamless API that allows developers to integrate payment solutions into websites and mobile applications with minimal friction.

- Recurring Billing Solutions: Stripe’s billing services make it easy for businesses to handle subscription-based payments, including complex pricing models and international currencies.

- Cross-Border Payments: Stripe facilitates international payments, enabling businesses to accept payments from customers all over the world.

- Fraud Prevention: With its advanced machine learning tools, Stripe provides a robust fraud detection system to protect businesses from fraudulent activities.

- Technological Innovation: Stripe’s developer-centric approach has allowed it to build a loyal customer base, especially among tech startups and software-as-a-service (SaaS) businesses. Its API-first model makes it easy for businesses to integrate payment solutions without needing extensive technical knowledge. Stripe also leads the way in blockchain-based payments and machine learning-driven fraud detection.

5. Square: Empowering Small Businesses

Market Share: Square, founded in 2009 by Twitter co-founder Jack Dorsey, has grown into one of the most influential payment processing companies, particularly in the U.S. Square has a strong foothold in the small business market, providing affordable and easy-to-use payment solutions. Square’s presence as one of the largest payment processing companies has enabled it to empower small businesses to thrive.

Key Services:

- Point-of-Sale (POS) Systems: Square offers a range of POS solutions, from mobile card readers to sophisticated POS systems for retail stores and restaurants.

- Mobile Payments: Square’s mobile payment system allows businesses to accept payments on-the-go, enabling small businesses to process transactions anywhere.

- Business Analytics and Reporting: Square provides its clients with detailed analytics and reporting tools that help track sales, customer behavior, and inventory.

- Technological Innovation: Square’s integration of data analytics into its payment systems helps small businesses make data-driven decisions. The company is also innovating in the cryptocurrency space with its Cash App, allowing users to buy and sell Bitcoin.

Conclusion

Tech Consulting, End-to-End Product Development, Cloud & DevOps Service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]