What Is A B2B Payment Solution? Everything You Need To Know!

It’s undeniable that technology has greatly benefited business operations, fostering professionalization. Nowadays, businesses are transforming B2B payment procedures, preferring electronic transactions over paper checks thanks to technological advancements.

Besides, innovative payment technologies facilitate global networking and connectivity, inundating the market with diverse options. Yet, selecting the appropriate B2B payment solution amidst this abundance can prove challenging.

For you, a newbie in this field, we’ve crafted a comprehensive article about ‘What is a B2B payment solution?’ This article aims to outline the B2B payment process, current trends, popular options, and key considerations for selecting the right solution. Let’s dig in!

Understanding B2B payment solutions

Let’s begin by breaking down the definition of B2B payment solutions and exploring their popular methods. This will provide you with an overview of this business model.

Definition

Business-to-business (B2B) payments entail the exchange of goods or services for a set value in currency. These transactions can occur either as recurring or single payments, contingent upon the agreed terms between the buyer and seller.

In contrast, Business to business payment solutions are platforms that enable businesses to electronically exchange money for the goods or services they offer each other. Unlike B2C payments, which involve intricate processes such as invoicing, approval, reconciliation, and reporting, B2B payment solutions aim to streamline and automate these procedures. B2B payment solutions prioritize security, transparency, and compliance features.

How do B2B payments work?

B2B payments refer to financial transactions between two businesses, where one provides goods or services to the other. This typically involves issuing an invoice that outlines the amount owed and payment terms. The provider sends the invoice to the buyer, who then pays according to the agreed terms, which can include immediate payment, payment after a set period (e.g., net 30 or net 60), or in installments.

Payment methods vary and can include bank transfers, checks, credit or debit cards, or online payment platforms. One thing to note is that the time it takes to process the payment depends on the chosen method and terms. Once payment is made and received, both businesses update their financial records, completing the transaction. In addition, we’ve got an article about “Segmented Digital Customer Experience for B2B Customers.” Give it a read to grasp how B2B payments not only benefit businesses but also enhance the customer experience. Then, in the next section, we’ll explain 6 of the most popular B2B payment methods, along with their pros and cons.

If you’re scratching your head over which B2B payment solution suits your business best or wondering about integrating technology into your business strategy, we’ve got your back. Our Savvy team, well-known for its IT outsourcing services at Savvycom since 2009, has been providing top-notch solutions for internet businesses such as B2B, banking apps, and more. We’ll help you figure out your next moves, guide you through the development process, and even provide a free estimate to elevate your business. Feel free to reach out to us for further consultation today!

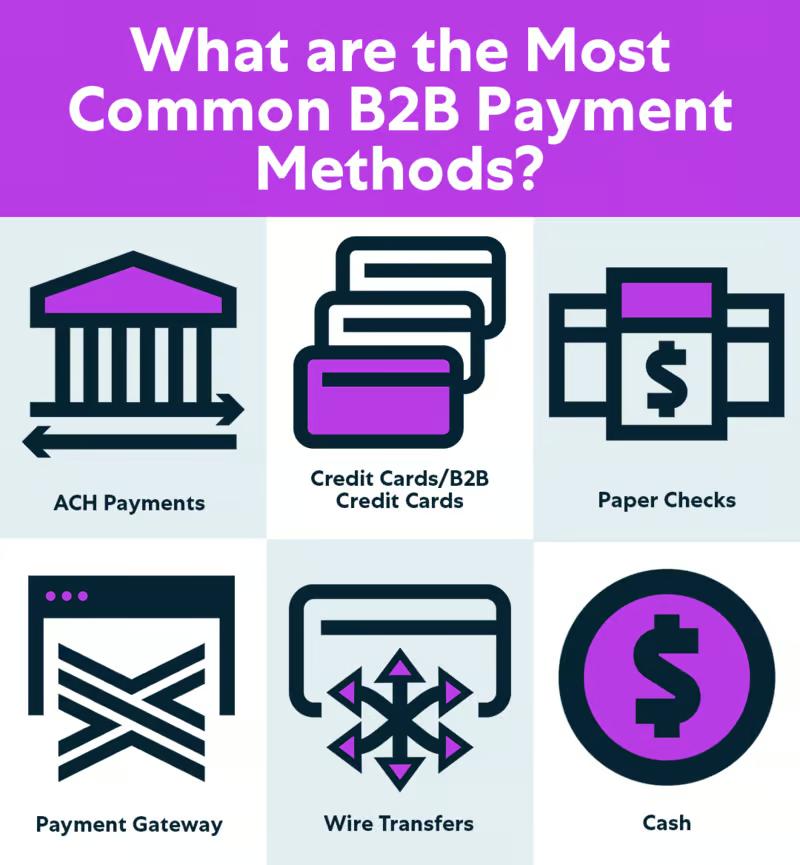

Most common types of B2B payments

In the current business market, there are six types of business-to-business payments, each with its own set of pros and cons. Let’s delve into them carefully below:

At present B2B payment methods have 6 types

- Paper checks: Physical documents that authorize fund transfers between bank accounts. This method is easy to use and widely accepted, albeit slow, costly, and susceptible to fraud and errors.

- ACH payments: Electronic transfers facilitated through the Automated Clearing House network. These transfers are fast, secure, and low-cost; however, they require the payer to possess the payee’s bank account information and may impose transaction amount limits.

- Wire transfers: Electronic transfers managed through banks or financial institutions. This method offers reliability, security, and capability to handle large amounts; nonetheless, wire transfers tend to be expensive, complex, and prone to delays or errors.

- Credit cards: Plastic cards allowing the payer to borrow money from the issuer and repay it later. Credit cards provide convenience, flexibility, and various rewards and protection; nevertheless, they come with high fees, interest rates, and risks of fraud and chargebacks.

- Cash: Physical currency serving as legal tender. Cash offers anonymity, immediacy, and low-cost transactions; however, it carries risks, inconvenience, and challenges in tracking and reporting.

- Banking platforms: Online services or applications enabling money transfers between parties. These platforms offer speed, ease of use, and innovation, although they may involve fees, limits, and compatibility issues.

The importance of B2B payment solutions

B2B payment solutions are crucial for modern businesses operating in today’s global digital landscape. These solutions offer numerous benefits such as saving time and money, improving cash flow, simplifying bookkeeping, and enhancing payment security.

By adopting business to business payment solutions, businesses can sidestep the complexities and risks associated with traditional methods like paper checks, wire transfers, and cash. Instead, they can capitalize on the convenience and efficiency of electronic, online, and mobile payments. Moreover, these solutions provide access to real-time data and reporting, facilitating better financial decision-making by enabling businesses to track payments, monitor cash flow, and review detailed transaction histories.

Furthermore, business to business payment solutions streamline cross-border transactions, which are essential for international trade and commerce. Digital payment platforms allow businesses to overcome hurdles such as currency conversion, fluctuating exchange rates, and compliance with regulations. They facilitate fast and secure payments across borders, promoting smoother business operations on a global scale.

What is the best payment method for B2B?

Choosing the right payment method for B2B transactions is a pivotal decision that can have a profound impact on your business. Factors like cost, processing time, security, and your business’s specific requirements are paramount considerations. With numerous B2B payment providers available online, each offering a range of solutions, including B2B payment software designed to streamline transactions and boost efficiency, the choices can be overwhelming.

It’s essential to delve into your target audience’s preferred payment methods and examine what your competitors are offering. This insight enables you to make informed decisions that align with your business objectives. A well-chosen B2B payment method not only simplifies transactions but also strengthens relationships with your business partners, thereby fostering growth and success.

It’s crucial to understand that there’s no one-size-fits-all solution when it comes to B2B payment methods. It’s about striking the right balance that caters to your business’s unique needs and objectives. By carefully assessing your options and understanding your business landscape, you can identify the optimal B2B payment solution that propels your business forward.

Top 3 B2B payment providers, solutions, and platforms

B2B payments are undergoing constant evolution towards enhanced efficiency, security, and convenience. In 2024, numerous B2B payment providers, solutions, and platforms offer distinct features and advantages for businesses. Here are the top 3 to consider, based on Paddle, a well-known platform providing top-notch B2B payment solutions.

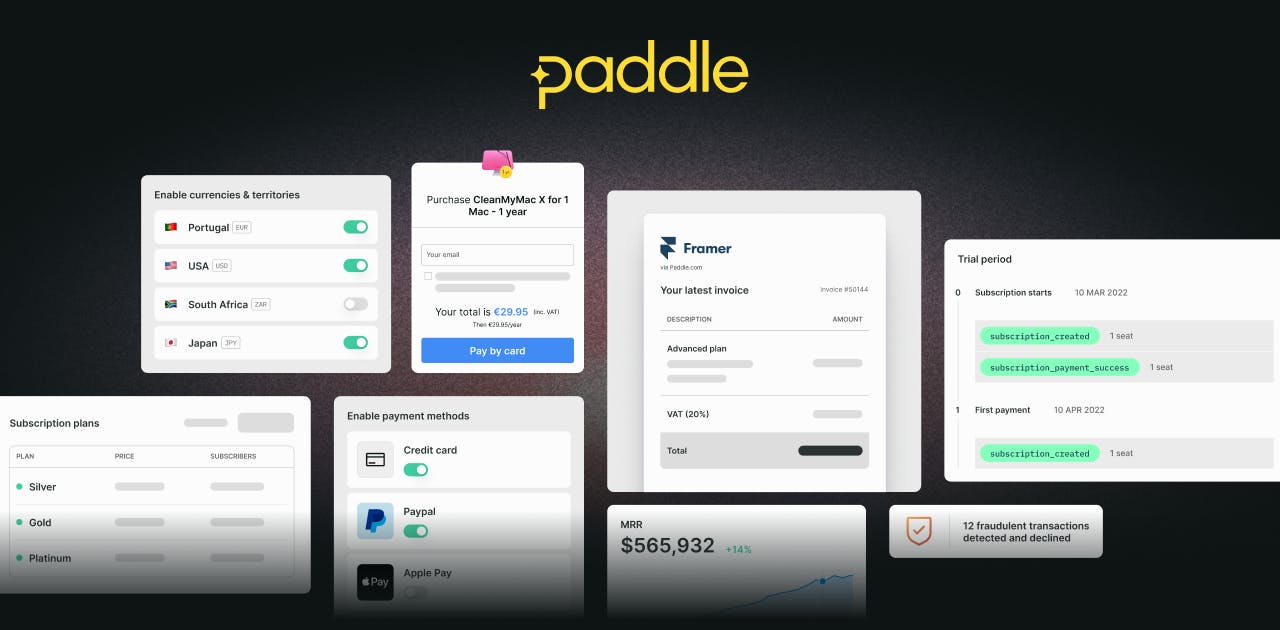

Paddle

Paddle stands as a unified B2B payment platform amalgamating billing, subscription management, and payment processing into a single solution. It facilitates payments from customers across 200+ countries, accommodating diverse methods like credit cards, PayPal, and Apple Pay.

A Powerful Tool for Digital Businesses

- Pricing: Tiered structure including a percentage of monthly revenue and a fixed transaction fee.

- Functionality: Billing, subscription management, and payment processing.

- Limitations: Absence of support for ACH payments, wire transfers, or checks. It also lacks advanced analytics and reporting features.

Ideal for businesses in software or digital product sectors seeking streamlined payment operations and global expansion.

Stripe

Stripe offers a comprehensive B2B payment solution enabling businesses to accept and manage online payments globally. It facilitates various payment methods including credit cards, ACH payments, wire transfers, and digital banking solutions.

The Top Choice for Online Businesses

- Pricing: Pay-as-you-go model involving a percentage of transaction amount and fixed fees per successful payment.

- Functionality: Payment processing, invoicing, billing, subscription management, fraud prevention, and reporting.

- Limitations: No phone or chat customer support and lacks tax compliance and currency conversion for cross-border payments.

Suited for businesses desiring a robust and adaptable payment system integration into their websites or applications.

Braintree

Braintree offers a smooth and secure B2B payment platform designed to accept and handle payments across different channels and devices easily. It supports various payment methods like credit cards, PayPal, Venmo, and Apple Pay.

Streamlined Payments Across Multiple Platforms and Devices

- Pricing: It operates on a pay-as-you-go model, where you pay a percentage of the transaction amount along with fixed fees for each successful payment.

- Features: Braintree provides essential functionalities including payment processing, invoicing, billing, subscription management, fraud protection, and reporting.

- Limitations: However, it does not support ACH payments, wire transfers, or checks. Additionally, it lacks advanced analytics and customization features.

Braintree is a good fit for businesses looking to ensure a uniform payment experience across various platforms and devices.

Conclusion

So, what is a B2B payment solution? Well, it’s all about how these solutions are super important for businesses nowadays. They bring efficiency, security, and convenience to the table. But picking the right one means looking at stuff like how much it costs, how long it takes to process payments, and what your business really needs. Remember, there’s no one-size-fits-all solution.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]