What Is A B2B Payment Solution? Everything You Need To Know!

In today’s fast-paced business environment, technology has revolutionized operations and professionalized processes across various sectors. One notable change is the transformation of business-to-business payments, where businesses increasingly favor electronic transactions over traditional paper checks.

However, the wide array of choices can make selecting the right B2B payment processing solution a daunting task, especially for newcomers to this space. To facilitate your understanding, we have crafted this comprehensive guide on ‘What is a B2B payment solution?’ This article will outline the B2B payment process, highlight current trends, explore popular options, and provide key considerations for choosing the ideal solution. Let’s dive in!

Understanding B2B payment solutions

To begin with, let’s clarify what B2B payment solutions entail and explore the popular methods used within this business model.

Definition

Business-to-business (B2B) payments refer to the transactions between two businesses in exchange for goods or services. These can occur either as single payments or recurring payments, depending on the terms established between the buyer and seller.

B2B payment solutions are platforms that facilitate the electronic transfer of funds for these transactions. Unlike business-to-consumer (B2C) payments, which involve more complex procedures such as invoicing solutions, approval workflows, and reconciliation, B2B payment solutions focus on streamlining and automating these processes. Key features of B2B solutions include heightened security, transparency, and compliance.

How do B2B payments work?

B2B payments typically involve an invoice issued by one business detailing the amount owed and the payment terms. The seller dispatches the invoice to the buyer, who then processes the payment based on the agreed-upon conditions, which may include immediate payment, deferred payment (e.g., net 30 or net 60), or installments.

Payment methods can vary widely, including bank transfers, checks, credit or debit cards, and digital payment methods. The processing time for payments usually depends on the selected method and the associated terms. Upon payment completion, both businesses update their financial records to mark the transaction as fulfilled. In addition, we’ve got an article about “Segmented Digital Customer Experience for B2B Customers.” Give it a read to grasp how B2B payments not only benefit businesses but also enhance the customer experience. Then, in the next section, we’ll explain 6 of the most popular B2B payment methods, along with their pros and cons.

If you’re feeling overwhelmed by the abundance of options available or uncertain about integrating technology into your business strategy, we are here to help. Our Savvy team at Savvycom has been recognized for its exceptional IT outsourcing services since 2009. We specialize in providing tailored solutions for various internet businesses, including B2B transactions and banking applications. Reach out to us today for guidance through the development process, and we can provide a free estimate to empower your business.

Most common types of B2B payments

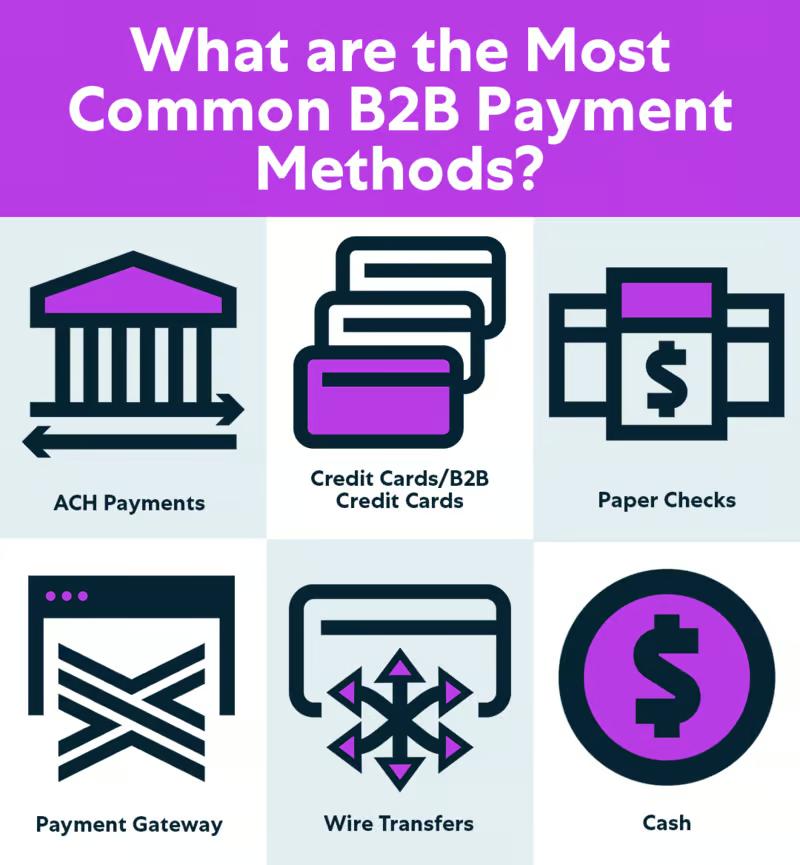

In the current business climate, there are six prevalent types of B2B payments, each with unique advantages and disadvantages. Let’s explore them in detail:

At present B2B payment methods have 6 types

-

Paper Checks: Traditional physical documents that authorize funds to be transferred between bank accounts. Although easy to use and widely accepted, checks can be slow, costly, and prone to fraud and errors. According to a study by the Aite Group, 87% of businesses still receive payments via paper checks.

-

ACH Payments: Electronic transfers conducted via the Automated Clearing House network. ACH payments are fast, secure, and low-cost. However, they require the payer to have the payee’s bank account information and may have transaction limits. The National Automated Clearing House Association (NACHA) reported that ACH payment volumes reached over 34 billion transactions in 2021, marking a 20% increase from 2020.

-

Wire Transfers: Electronic transfers made through banks or financial institutions. While reliable and capable of handling large amounts, wire transfers can be expensive, complex, and susceptible to delays.

-

Credit Cards: Cards that allow users to borrow funds from the issuer. Credit cards offer convenience and potential rewards but can incur high fees and interest rates, with risks of fraud and chargebacks.

-

Cash: Physical currency providing anonymity and immediate transactions. Despite low costs, cash transactions pose risks and complications related to tracking and reporting.

-

Banking Platforms: Online services enabling seamless money transfers between parties. While these platforms are efficient and user-friendly, they may come with fees, limits, and compatibility issues.

The importance of B2B payment solutions

B2B payment solutions are critical for modern businesses navigating today’s global digital landscape. They provide numerous benefits, including time and cost savings, improved cash flow, simplified bookkeeping, and enhanced payment security.

By utilizing B2B payment solutions, companies can avoid the complexities and risks associated with traditional payment methods like paper checks and wire transfers. Instead, they can leverage the convenience of electronic, online, and mobile payments. Moreover, these solutions offer access to real-time data and reporting, which supports informed financial decision-making by allowing businesses to track payments, monitor cash flow, and analyze transaction histories.

As part of a broader digital transformation strategy, integrating advanced payment solutions can drive IoT digital transformation initiatives, enabling businesses to connect seamlessly with customers and suppliers. These advancements pave the way for successful digital transformation, enhancing overall operational efficiency.

These solutions also simplify cross-border payments, essential for international trade. Digital payment platforms help businesses navigate challenges such as currency conversion and regulatory compliance, enabling fast and secure payments on a global scale.

What is the best payment method for B2B?

Selecting the right payment method for B2B transactions is a crucial decision that can significantly affect your business. Factors such as cost, processing time, security, and the specific needs of your enterprise are paramount in this evaluation.

Additionally, it is important to analyze your target audience’s preferred payment methods and review competitors’ offerings. This insight can guide informed decisions that align with your business objectives. A well-selected B2B payment method not only streamlines transactions but also strengthens relationships with business partners, fostering growth and success.

To ensure optimal customer experiences, businesses should also follow e-Wallet best practices, such as ensuring security, offering user-friendly interfaces, and supporting multiple payment options. The best e-wallet apps not only enhance user engagement but also provide a versatile platform for managing various transactions.

Remember, there is no one-size-fits-all solution in B2B payments. Striking the right balance to meet your unique business requirements is key. By thoroughly assessing your options and understanding the landscape, you can identify the optimal B2B payment solution that propels your business forward.

Top 3 B2B payment providers, solutions, and platforms

B2B payments are undergoing constant evolution towards enhanced efficiency, security, and convenience. In 2024, numerous B2B payment providers, solutions, and platforms offer distinct features and advantages for businesses. Here are the top 3 to consider, based on Paddle, a well-known platform providing top-notch B2B payment solutions.

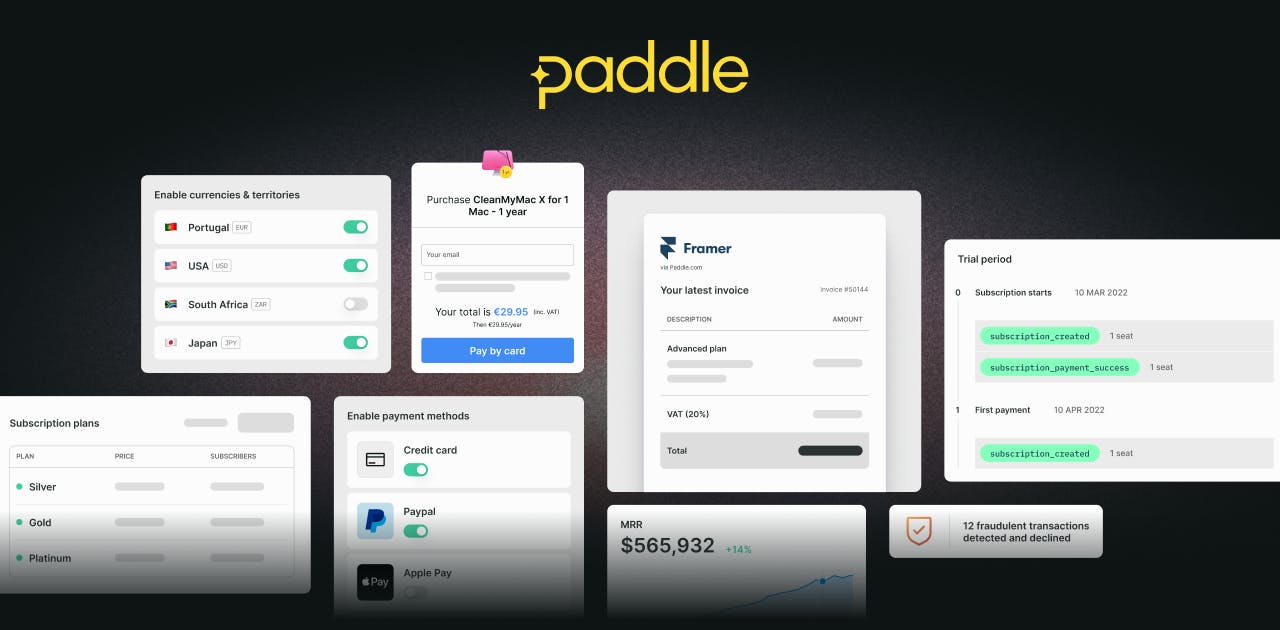

Paddle

A unified B2B payment platform that integrates billing, subscription management, and payment processing. Paddle caters to customers in over 200 countries and supports diverse payment methods such as credit cards, PayPal, and Apple Pay.

A Powerful Tool for Digital Businesses

- Pricing: Tiered structure based on a percentage of monthly revenue plus a fixed transaction fee.

- Functionality: Includes billing, subscription management, and payment processing.

- Limitations: Does not support ACH payments, wire transfers, or checks, and lacks robust analytics features.

- Ideal For: Businesses in the software or digital product sectors seeking streamlined operations and global reach.

Stripe

A comprehensive B2B payment solution that allows businesses to manage online payments worldwide. Stripe supports various payment methods, including credit cards, ACH payments, and wire transfers.

The Top Choice for Online Businesses

- Pricing: Pay-as-you-go model involving a percentage of each transaction plus fixed fees.

- Functionality: Encompasses payment processing, invoicing, subscription management, fraud prevention, and reporting.

- Limitations: No dedicated customer support via phone or chat, and lacks tax compliance for international payments.

- Ideal For: Businesses needing a robust and flexible payment integration within websites or applications.

Braintree

A user-friendly B2B payment platform designed to handle transactions across multiple channels and devices. It supports diverse payment methods, including credit cards, PayPal, Venmo, and Apple Pay.

Streamlined Payments Across Multiple Platforms and Devices

- Pricing: Operates on a pay-as-you-go basis, based on a percentage of transaction amounts plus fixed fees.

- Functionality: Provides essential features like payment processing, invoicing, subscription management, and fraud protection.

- Limitations: Does not support ACH payments or wire transfers and lacks advanced analytics.

- Ideal For: Businesses seeking a consistent payment experience across various platforms and devices.

Conclusion

In summary, B2B payment solutions play a vital role in enhancing efficiency, security, and convenience for modern businesses. Selecting the right method involves carefully considering costs, processing times, security measures, and specific business needs. As part of your growth strategy, consider partnering with e-wallet app development companies to create tailored solutions. This will enable you to leverage the benefits of e-wallet technology and drive customer engagement.

Keep in mind that there is no universal solution, and finding the right fit is crucial for success in your B2B transactions. By understanding your unique landscape and making informed choices, you can position your business for continued growth and prosperity.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: contact@savvycomsoftware.com