What Is Outsourcing In Financial Services? Comprehensive Overview

Integrating technology into business operations lowers costs, enhances accuracy, and frees up resources for other tasks. Consequently, numerous businesses opt to outsource financial services, recognizing the significance of accounting and finance in their operations. Various industries find financial outsourcing highly beneficial without interrupting their operations. So, what is outsourcing in financial services? what are the benefits, and the pros and cons? Well, this article has all the answers!

What Is Outsourcing In Financial Services?

Outsourcing in financial services means hiring outside firms to handle financial tasks instead of managing them in-house. Unlike handling everything internally, outsourcing shifts responsibilities to specialized providers, which can lower costs and boost efficiency. Tasks like payroll processing, bookkeeping, tax preparation, and managing accounts payable/receivable are often outsourced. Also, processes like financial analysis, budgeting, and auditing can be outsourced too. This strategy lets companies focus on what they do best while tapping into external software development companies for other activities.

What Are Some Famous Outsourced Finance And Accounting Services?

What Are Some Famous Outsourced Finance And Accounting Services?

In this section, we’ll outline the four most common types of outsourced financial services to help you gain more knowledge about outsourcing in financial services.

Accounting Services

According to The Business Research Company, an authority in financial analysis, the accounting services market has shown consistent growth in recent years. It is projected to increase from $652.32 billion to $676.73 billion by 2024, with a compound annual growth rate (CAGR) of 3.7%. This data assures us that outsourced accounting services bring a breath of fresh air to businesses, simplifying operations and boosting efficiency. By handing over financial tasks to external experts, companies can lighten their load and focus on what truly matters. Unlike traditional in-house setups, outsourcing offers tailored solutions that fit like a glove, granting both financial wiggle room and managerial freedom.

Image source: The Business Research Company

Here are five essential types of outsourced accounting services:

- Bookkeeping: External firms manage day-to-day financial recording and reporting, ensuring precision and regulatory compliance. These comprehensive financial book services include maintaining general ledgers, recording transactions, and generating financial statements that provide businesses with accurate insights into their financial position. By outsourcing these critical bookkeeping functions, companies can ensure their financial records are maintained to the highest professional standards while freeing up internal resources for strategic initiatives.

- Managing Accounts Payable and Accounts Receivable: Expert professionals handle financial inflow and outflow, optimizing cash flow and minimizing financial risks. By combining traditional outsourcing expertise with modern technology, businesses can further enhance efficiency and accuracy, for example by adopting AI accounts receivable automation to streamline invoice processing and accelerate collections.

- Tax Accounting: Specialized providers handle tax preparation, ensuring adherence to tax laws and regulations.

- VAT Administration: Outsourced firms oversee Value Added Tax (VAT) compliance and reporting, easing administrative burdens and ensuring accuracy.

- Bank Reconciliation and Payroll Services: External providers reconcile bank statements and manage payroll processes, ensuring financial precision and regulatory compliance.

Outsourcing in accounting services open doors to specialized resources, optimizing financial processes and paving the way for strategic growth initiatives.

Are you struggling to find a trustworthy IT outsourcing service builder?

At Savvycom, we’re honored to be acknowledged as one of the premier IT outsourcing companies in Asia. We specialize in healthcare analysis, financial software development services, bank outsourcing services, and more. Don’t hesitate—reach out to us today, and let’s bring your ideas and dreams to life, hand in hand. Get in touch, and let the journey begin!.

Investment Management

|

Advantages |

Disadvantages |

|

Expert insights and specialized skills |

Loss of direct control over decisions |

|

Cost-effectiveness |

Potential risks to confidentiality |

|

Flexible resource allocation |

Dependency on external providers |

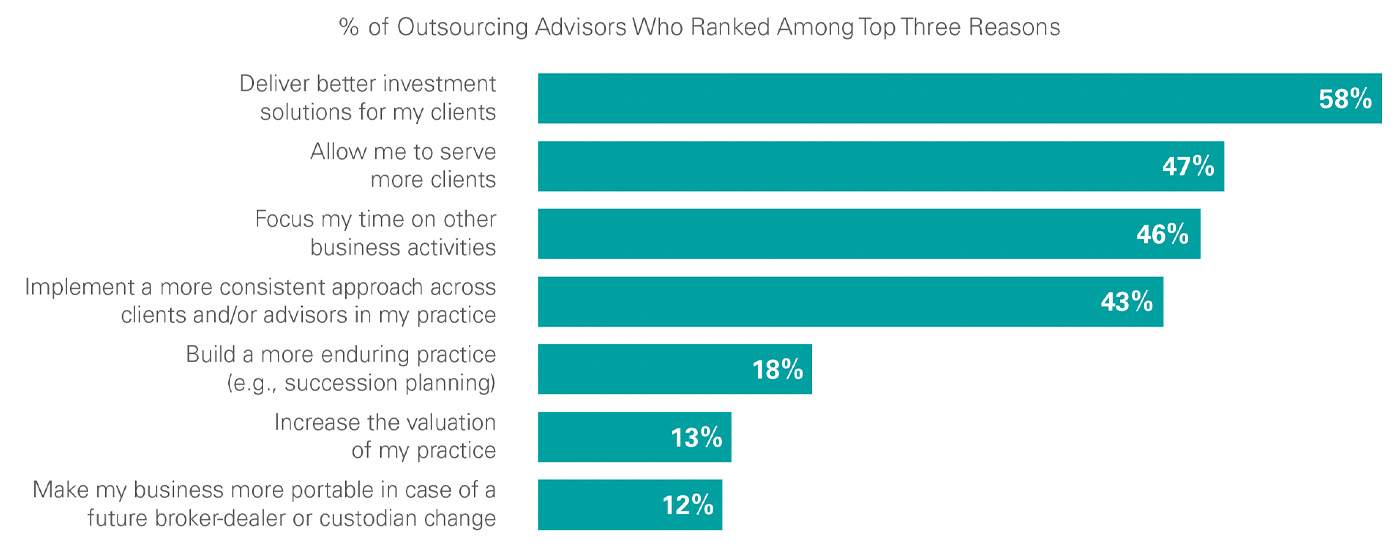

According to Investment News, advisers who outsource investment management could bring in $1 million more in revenue over a decade than those that manage their clients’ portfolios in-house. About 60% of investment managers are looking to outsource some of their non-core functions to boost cost-efficiency, a study by financial services company Northern Trust revealed.

Image source: Proactive Advisor Magazine

Financial Analysis

Outsourcing financial analysis involves assigning critical financial tasks to external experts, particularly beneficial for companies in the financial sector. The advantages are clear:

- Access to Expertise: Companies tap into a wealth of experience, ensuring accurate financial analysis.

- Cost Savings: Outsourcing cuts staffing and infrastructure costs, reducing operational expenses.

- Focus on Core Goals: By outsourcing financial analysis, companies concentrate on key competencies, fostering growth.

- Flexibility: Businesses can adjust resources as needed, thanks to the flexible nature of outsourcing.

- Risk Management: External specialists mitigate compliance and reporting risks, maintaining industry standards.

Thus, financial outsourcing solutions streamline operations, boost efficiency, and enhance competitiveness in ever-changing markets.

Underwriting and Claims Payments

A lot of insurance companies worldwide are increasingly turning to outsourcing for underwriting and claims payments, a strategic move aimed at streamlining operations and boosting efficiency. Poor Claims Experiences Could Put Up to $170B of Global Insurance Premiums at Risk by 2027, according to new Accenture Research.

Notable firms like Unity Communications and Big Outsource have excelled in claims processing outsourcing, earning top ratings and glowing reviews. These specialized providers adeptly handle various insurance claims, including property insurance, underwriting, and data processing. By tapping into external expertise, insurers can refocus on core functions while ensuring precise and prompt claims processing.

Pros And Cons Of Outsourcing in Financial Services

Similar to how every coin has two sides, financial outsourcing presents both advantages and disadvantages. In the following section, we will explore what these entail.

|

Pros Financial outsourcing brings several benefits to institutions. By streamlining processes and leveraging external expertise, outsourcing enhances efficiency while fostering scalability. This flexibility empowers financial institutions to adapt swiftly to market shifts, optimizing performance and resource allocation effectively. |

Cons While financial outsourcing offers numerous benefits, it also presents notable drawbacks and risks. To address these challenges in cons, meticulous vendor selection in IT outsourcing services, clear communication protocols, and stringent security measures are essential to safeguard sensitive financial information and maintain operational resilience. |

|

Cost savings: Outsourcing financial tasks helps cut operational expenses, freeing up funds for other priorities. |

Loss of Control: Entrusting critical financial functions to external providers may result in a loss of control over processes and data, affecting decision-making and business agility. |

|

Access to expertise: By outsourcing, institutions tap into specialized skills and knowledge they may lack internally, enriching their capabilities. |

Communication Challenges: Outsourcing often creates communication barriers between the company and service providers, impeding clarity, responsiveness, and alignment with organizational objectives. This can lead to misunderstandings and delays in financial operations. |

|

Improved efficiency: Institutions can focus on core activities while outsourcing routine tasks, streamlining operations for smoother workflow. |

Risks of Sensitive Data Breaches: Sharing sensitive financial data and processes with external parties increases the risk of data breaches, confidentiality breaches, and non-compliance with regulations. Without robust security measures and oversight, outsourcing sensitive financial functions poses significant risks to data integrity and organizational reputation. |

|

Scalability: Outsourcing enables institutions to adjust their operations easily, accommodating changes in business demands without hassle. |

|

|

Reduced risk: With outsourcing, institutions reduce risks associated with compliance, technology, and staffing, relying on the expertise of outsourcing partners for greater stability. |

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

How To Choose The Right Outsourcing Provider

Outsourcing in financial services has become a go-to strategy for businesses aiming to streamline operations, cut costs, and stay focused on what they do best. Yet, picking the right outsourcing partner can feel like navigating a maze. Here are some down-to-earth tips to help you find the perfect match:

- Know What You Need: Start by jotting down exactly what tasks you want to hand over. Be clear about deadlines, expectations, and what success looks like for you. A clear roadmap makes outsourcing in financial services more effective and efficient.

- Look for Experience: Seek out providers who know the ins and outs of your industry. Check out their success stories and what their clients say about them. Successful outsourcing in financial services relies on experience and domain knowledge.

- Check the Money Side: Take a peek into their financial health to ensure they’re in it for the long haul. A stable partner means fewer headaches down the road. Long-term reliability is a cornerstone of successful outsourcing in financial services.

- Think About Location: Consider whether you want someone close by or halfway across the globe. Each has its perks, from shared time zones to cost savings. Proximity can simplify communication, while offshore outsourcing in financial services may offer cost advantages. Weigh the trade-offs to match your priorities.

- Keep Quality and Security in Mind: Make sure they’re up to scratch on quality checks and keeping your data safe. ISO certifications and watertight security are must-haves outsourcing in financial services.

- Flexibility is Key: Your business might grow (fingers crossed!), so make sure your partner can grow with you. Flexible contracts and the ability to adapt to changes are crucial for outsourcing in financial services to succeed over the long term.

- Get to Know Them: Schedule a meet-and-greet to see if you click. Ask about worst-case scenarios and how they handle them. Strong rapport fosters trust in outsourcing in financial services.

- Communication Counts: A good chat goes a long way. Make sure they’re easy to reach and keep you in the loop.

- Price Wisely: Cheap isn’t always cheerful. Prioritize value and long-term benefits when considering outsourcing in financial services.

- Test the Waters: Consider a trial run before you dive in headfirst. It’s like a first date – you want to make sure it’s a good fit before committing long-term.

By following these steps, you’ll be well-equipped to navigate the complexities of outsourcing in financial services and build a partnership that aligns with your business goals.

If you’re feeling overwhelmed by these suggestions, no need to stress because we’ve got your back! At Savvycom, we’re not just another IT outsourcing company – we’re your partners in success. Specializing in various fields like finance, healthcare, banking, manufacturing and education, we’re here to listen to your ideas, collaborate with you, and help bring your vision to life. Recognized in the top 10 Fintech companies with outstanding expertise and experiences working with many clients in BFST like The Banktech Group or Shinseung Tax Firm, we understand financial management is the backbone of any successful business. That’s why we offer top-tier custom software development services designed to revolutionize how companies approach finance software development. As one of the leading financial app development companies, we specialize in creating intuitive financial super apps that consolidate diverse functionalities into a seamless user experience. Our expertise also extends to financial risk management, helping businesses safeguard their operations while staying ahead of industry trends. With Savvycom, you gain a reliable partner dedicated to delivering innovative solutions for outsourcing in financial services.

| Learn More About Savvycom On: | |

| Savvycom Website |

The Manifest: |

| Dribbble | |

| Behance | |

Conclusion

Throughout our article about outsourcing in financial services, we can assure that various types of outsourcing financial services bring several advantages such as cost savings, access to expertise, and enhanced focus on core activities. However, it’s crucial to consider both the positives and negatives before selecting a provider that matches your business’s values, needs, and objectives. Partnering with the right provider can transform outsourcing into a strategic decision that drives your business toward success.

Tech Consulting, End-to-End Product Development, Cloud & DevOps Service! Since 2009, Savvycom has been harnessing digital technologies for the benefit of businesses, mid and large enterprises, and startups across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]

What Are Some Famous Outsourced Finance And Accounting Services?

What Are Some Famous Outsourced Finance And Accounting Services?